Monthly Challenge - Track expenses, save and invest an extra 100$ / mo for 40 years

Jan 05, 2021I don't know how many of you will remember, but one year ago at the beginning of 2020 I put out a video talking about 12 monthly challenges that I was going to be doing in 2020.

It started off pretty fun, I was getting a lot of people emailing and sharing their experiences, but of course a couple months into the year everything changed. Once the Covid situation happened I never mentioned it again because obviously people had more important things to focus on. That might still be true for many people this year, we're still not entirely through this mess so feel free to ignore me on this, but I thought I would again mention it now at the beginning of 2021 and see if any of you want to take part in some of these.

* The full YouTube video is down below

The challenge for January was to track expenses for 30 days right down to the penny.

The point of this challenge is that many people don't even realize how much "small money" they are wasting day to day until they actually see it written down, and that those small amounts here and there can add up to a lot at the end of the month. And then when you compound that amount of money over many years, it can actually be a very large amount of lost investment potential.

Track expenses for 30 days and see if you can find a few areas to save some money. Even just saving an extra 100$ a month can be a significant amount.

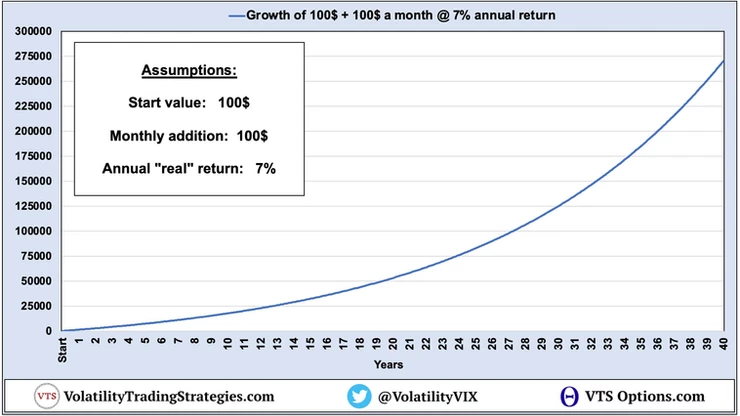

Starting at age 30, assuming a person started investing that extra 100$ in "small money" savings every month, here's how much that would end up being by retirement age of 70.

After 40 years, that measly 100$ a month would be an extra 270,000$ in retirement. 40,000$ of that was the original 100$ a month added along the way, so 230,000$ of it is pure investment gains. And that's based on a real annual return of 7%.

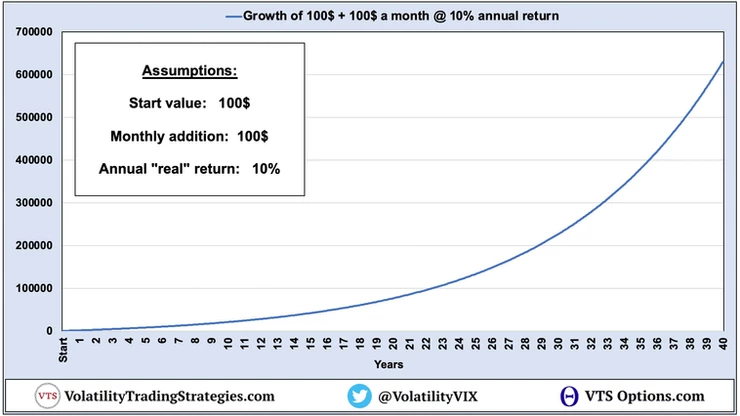

If a person did better than that, say with a certain Volatility Trading Strategies portfolio :) and earned 10% annual real return:

With a 10% annual return, starting with 100$ and adding just 100$ a month, after 40 years that person would have an extra 615,000$ in retirement. Earning 15% a year, that's 3.1 million dollars extra.

So if you want, feel free to participate in some of these monthly challenges. For January (and hopefully it becomes a habit) track expenses down to the penny and see if there are a few areas you can save some money.

Small amounts of extra savings can make a BIG difference when compounded over the average career time frame, with good investment choices that can return 7%+ per year. Don't underestimate the power of compound interest!

Check out the full video below:

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.