Best Asset Class for Low Volatility? Why it's NOT Stocks

Oct 08, 2021VTS Community,

In this article from last week, we went over the performance of 13 different ETFs and asset classes that could potentially replace the TLT allocation within the VB Threshold strategy.

With interest rates likely bottomed and possibly set to rise in the coming months and years, there's less of an argument to be holding Treasury's in our strategies going forward.

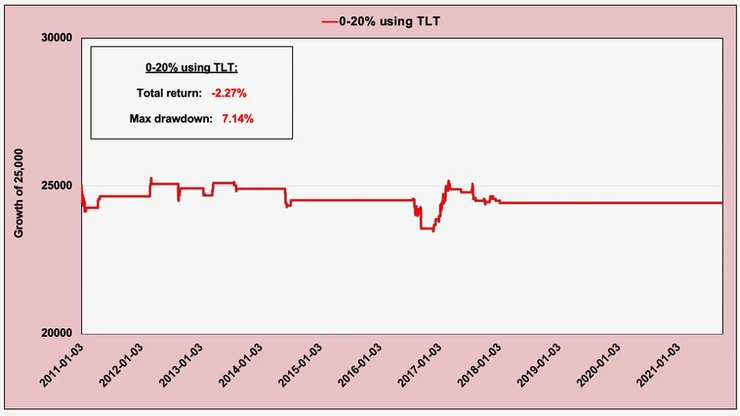

The VTS VB Threshold strategy was using TLT in two different sections of the Volatility Barometer. The higher volatility 60-80% range which is much more important and what the original article was talking about, but TLT was also being used in the low volatility 0-20% range, and I'd like to replace that as well.

So there's two openings that used to be occupied by the 20+ year Treasury ETF TLT that we need to replace, they say "Cash" now

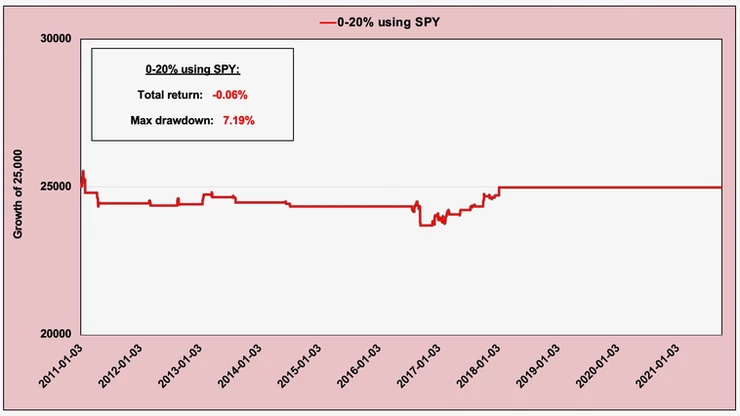

Why not just use the S&P 500 (SPY and SSO)?

Since the S&P 500 is being used from 20-60% already that does beg the question, why not just use the SPY below 20% as well? The short answer, we could. The issue there is, historically speaking when the VTS Volatility Barometer is in its lowest range below that 20% level, the S&P 500 hasn't had any performance worth capturing.

Now that might come as a surprise to many people. One might think that a low volatility environment would have the S&P 500 just slowly grinding higher right? Actually no, it comes with some whipsaw and mostly just sideways chop. The way I always like to think of it, when volatility gets into those extremely low ranges the market is already stretched and potentially just running on fumes at that point. It's not a contrarian prediction for a crash or anything, but at that point a pullback would be expected.

0-20% range using SPY (S&P 500)

The only bit of positive performance in the last 10 years was during that extended period of ultra low volatility in 2017. So if a period like that comes around again then the S&P 500 would likely perform pretty well. In my opinion though, those types of periods are too few and far between, and especially in this "new normal" type of market we're seeing develop here I find it hard to believe we'll see something like that again any time soon.

0-20% range using TLT (20+ yr Treasury)

When the strategy was originally designed years ago I did have my reasons to think that TLT would outperform the SPY which is why we've used it since, but long-term they were about the same in the end and now it's time to move on from TLT.

The 0-20% range is just a parking space for capital

That low volatility range in the market doesn't come around very often. In fact the Volatility Barometer is only below 20% on roughly 5% of trading days so it's never going to be a big profit range for the strategy anyway. It's more of a parking spot for capital when we know the S&P 500 is likely running on fumes. That being said though, maybe there is a better asset class to replace the TLT with other than just straight up cash.

* Side note, I do consider cash an active portfolio position and it is one of the potential choices here. Sometimes cash is actually better than any other asset class so we'll see.

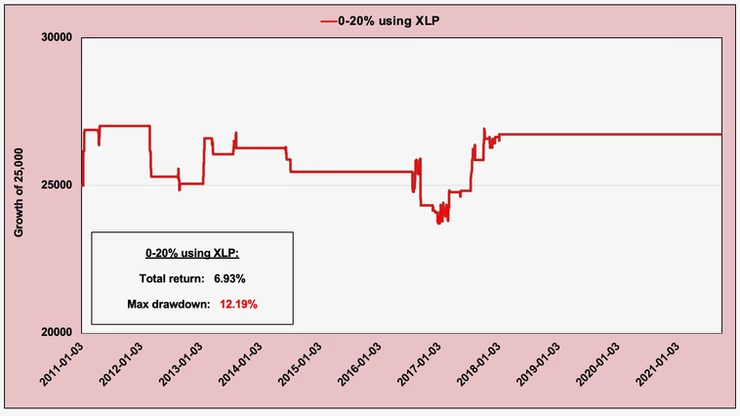

0-20% range using XLP (consumer staples)

Sometimes the consumer staples ETF is more stable than the S&P 500 so it was definitely worth a quick look. As you can see though, the drawdown was more significant than the SPY and I would only consider taking on more risk if the potential performance seemed well worth it. In this case it probably isn't.

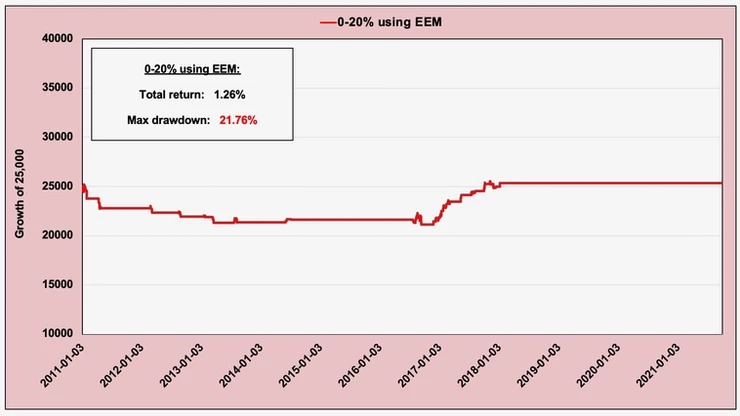

0-20% range using EEM (emerging markets)

I get a lot of email questions about emerging markets and why we don't use EEM in any of our strategies. There are times when it can perform very well which is why it catches people's attention. However, long term correlations can break down significantly with EEM and its often times just too hard to predict how it will react through different cycles. It has its moments of glory, but it also has potential for larger drawdowns which is why I wouldn't consider it here.

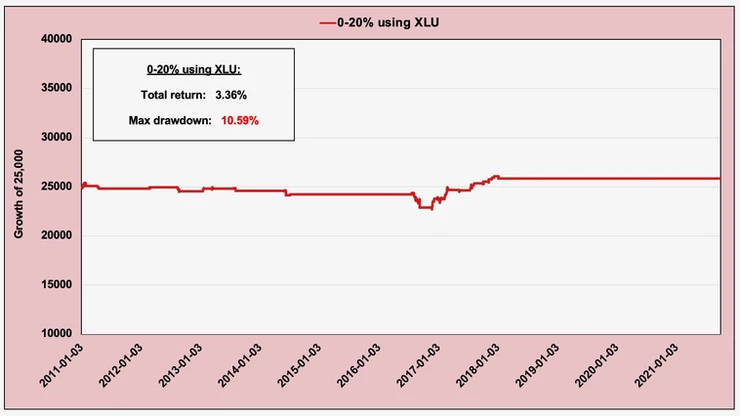

0-20% range using XLU (utilities)

XLU is one that I always use for testing in all volatility ranges and strategies as it has historically been a good performer in many places where the S&P 500 suffers. There's definitely a correlation between the two, but it's often more advantageous to utilities in certain higher risk ranges. In this case it does beat the S&P 500, but not by enough to make it viable.

Before showing the top 2, if you're getting value here:

Subscribe to the YouTube channel

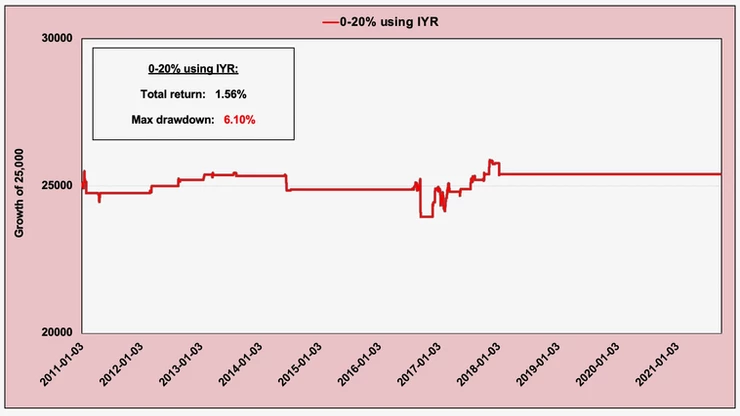

0-20% range using IYR (real estate)

This is interesting, and especially since IYR is also one of the top performing ETFs in the 60-80% range, an argument could be made for just bookending the strategy with real estate. Now the obvious question to ask here, is that really better than cash?

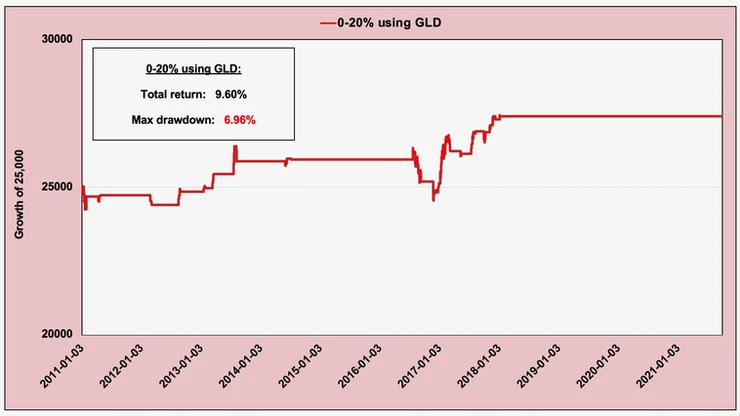

0-20% range using GLD (gold)

Always feel free to give feedback and express your own thoughts, but for me the GLD is really the only ETF of the bunch that I would consider over just cash or SPY. There is some drawdown expected here as the correlation between gold and volatility isn't perfectly consistent, but those periods of success would have helped out the strategy without too much cost so it is at least worth considering.

SPY vs Cash vs Gold

In my opinion those are the only viable choices here as the rest of the asset classes along with many others I tested just didn't make the grade. They either had no performance to capture, or they did but at the expense of drawdowns that were too large. So we'll only consider:

SPY: This would be the easiest choice and the one that would reduce the trade frequency the most. Just maintaining SPY in the entire 0-60% range would eliminate one of the thresholds and make things easier from a practical perspective. Sounds great, but the only problem is I'm not actually expecting any performance in the low range. Is that a deal breaker? No. Flat performance during low volatility is fine, but I will at least consider things that potentially offer a return as well.

Cash: Since the 0-20% range can be considered a "safety" position, there's nothing safer than cash.

Gold: Given my work in the last 10+ years I think most of you know my investing philosophy is strongly against buy and hold, and that's especially true for buy and hold gold. I really don't know why people do that, since it's so easy to add a few filters and dramatically improve the long term results. But as a strategic safety position it does start to make a lot more sense.

We already use the GLD in our Tactical Balanced strategy for the highest volatility range. Might it also be advantageous to use gold in the lowest volatility range within the VB Threshold strategy?

What do you think? Have a great weekend!

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.