What is the Ideal "Long Volatility" Trade Frequency for Tail Risk?

Feb 24, 2022VTS Community,

We've dedicated three blogs in the last several weeks talking about the bizarre nature of this market sell off. More specifically, how slow the volatility metrics have been in reacting to a crashing market which has now passed well into correction territory. The S&P 500 is currently down -13.2% from its all time high, and the Nasdaq is off -18.3%. Despite the significant decline, volatility metrics have been quite muted so far compared to all previous similar crashes in the last 10 years. If you want to check those articles out they are here, here, and here.

Having said that, a couple days ago we did get our first long volatility signal in the Strategic Tail Risk strategy, but just barely. We got the signal, made a little profit, and then back out again. Now if this terribly tragic Russia / Ukraine situation continues we may get more long volatility signals going forward, but today I wanted to go over a question that I've gotten quite a bit recently:

"Why don't we take more long volatility trades?"

The short answer is, it's very difficult to make money with long volatility positions so I tend to do it sparingly. On the other hand, we do need at least some tail risk exposure because at some point there's going to be a major financial crisis that savvy volatility traders can take advantage of. It's a real balancing act though getting those allocations correct. Too little and you miss opportunities. Too often and it just introduces a lot of whipsaw.

Market environments that potentially trigger long volatility signals are almost by definition going to be very news driven. If the headlines are bad and the market continues down, of course those long volatility positions can make a profit. But since the vast majority of the investing world including most institutions and fund managers are net long the market, any good news is usually met with an outsized bounce and significant volatility crush. Essentially, these environments are highly susceptible to whipsaw and strong reversals. Getting into profitable long volatility positions at the right time is hard enough, but hanging on to those gains on the other side is even harder.

I call this "the dreaded giveback."

At some point the market is going to bounce and recover. When that happens, the volatility metrics that got us into the trade in the first place don't go away in one day. They can linger a few days and some of the profit that was made is given back on the other side. You'll see that giveback clearly when we go through some charts.

How often ,should, we go long volatility?

The first step in trying to determine the ideal trade frequency of long volatility positions is to backtest different levels. I'll use the M1:M2 VIX futures going back to their inception in 2004 to filter for different trade frequency.

* Note, I'm not suggesting anybody reduce their trade signals to something this basic. The VIX futures on their own aren't nearly robust enough to successfully navigate the long volatility trade. This is just a way of dividing the market up so we can start gathering some data and draw a few initial conclusions.

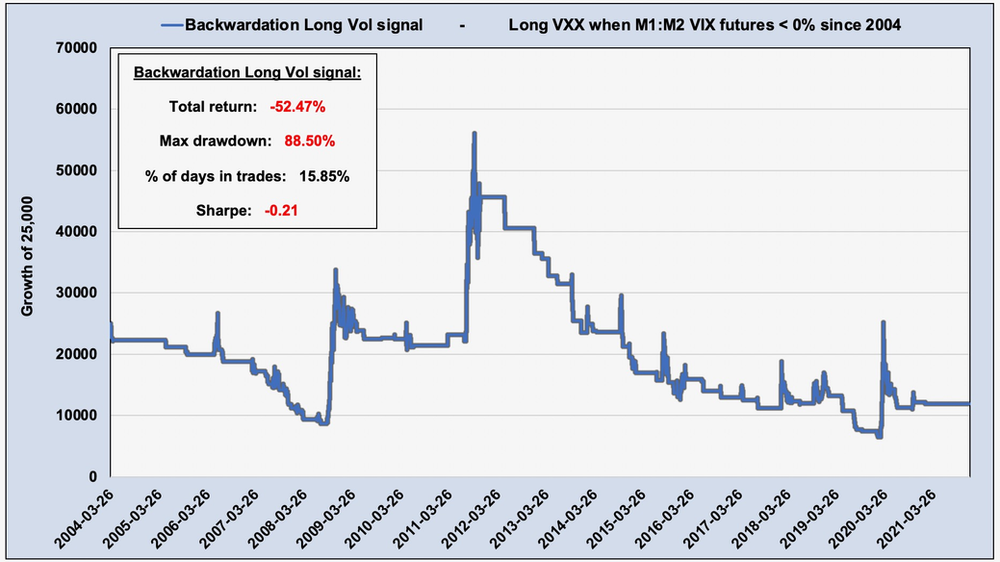

Long VXX when M1:M2 VIX futures are < 0% (backwardation)

VIX futures have been in backwardation 15.85% of trading days since 2004, which as you can see by those results is far too high a trade frequency to be long volatility.

While it's true that being that active would almost certainly mean the trader takes advantage of any market crashes, it also means they will be giving back all of that profit and then some on all the times where the market bounces. The giveback is very strong when being too willing to hold long vol.

Given the dismal performance it's quite interesting that you'll still see plenty of people on Twitter saying that all you have to do is short volatility when VIX futures are in contango, and go long volatility when they are in backwardation, and I guess money falls from the sky. Anybody who runs a 10 minute backtest on that will see it's a non starter of a strategy. But, that's Twitter for ya...

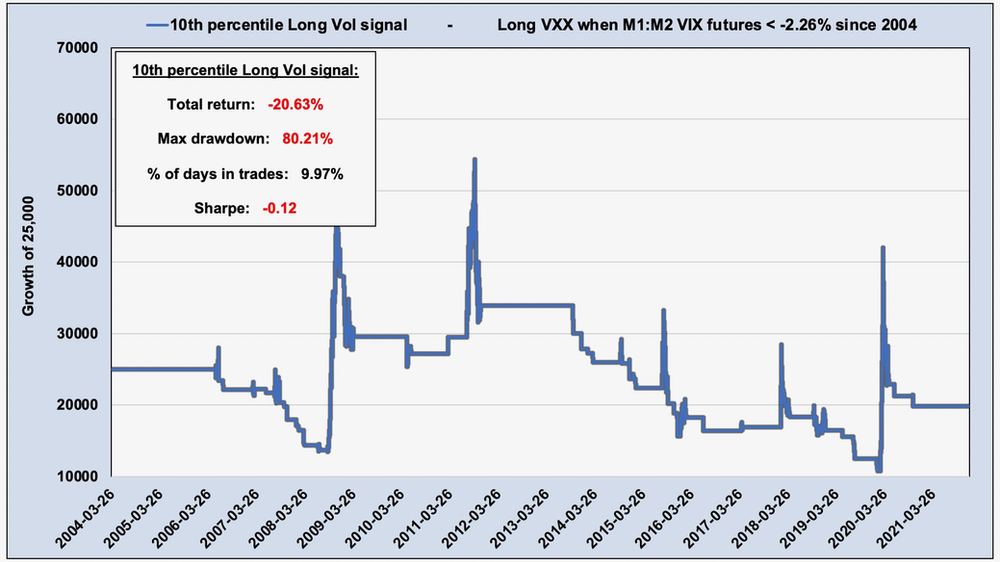

Long VXX when M1:M2 VIX futures within 10th percentile

The 10th percentile translates to a VIX futures backwardation level of -2.26%, but this is quite obviously still far too active. Again, easy to make profit when the market crashes, but very difficult to hang on to it on the other side.

Notice the abrupt spikes followed by big volatility crush? You don't want to be that trader that goes long volatility at the first sign of trouble. You'll probably feel like a rockstar for a few days, and then get the old gut kick when profit leaves the account just as quickly.

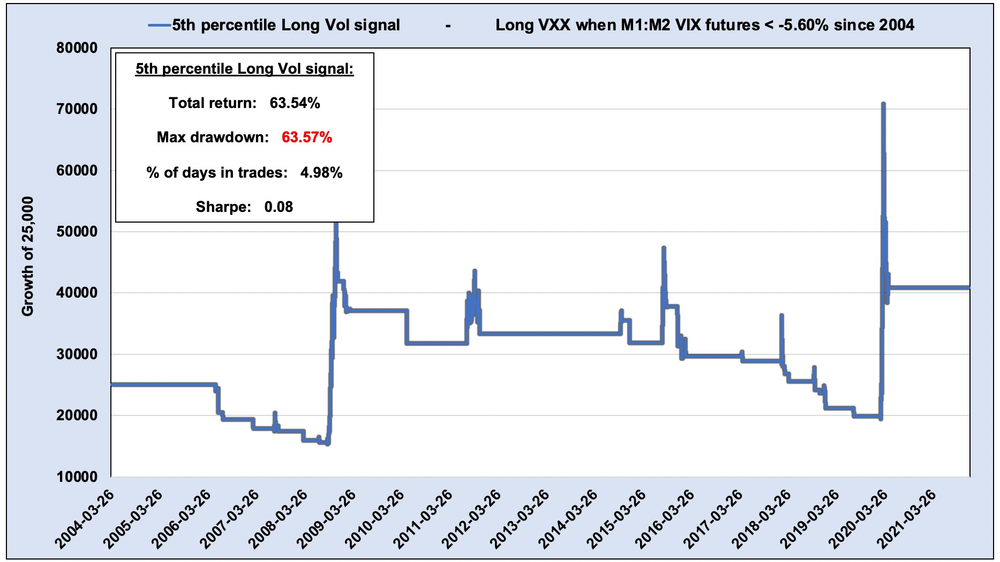

Long VXX when M1:M2 VIX futures within 5th percentile

The 5th percentile is when M1:M2 VIX futures are below -5.60% and this is the first level where some of the profit is actually realized long-term. Now we still see those big spikes when the market crashes (2008, 2010, 2011, 2015, 2018, 2020) which is the goal of the long vol trade. However, metrics often remain sticky long after the market has bounced, and a lot of the gain is given back while waiting for the futures to break above that 5th percentile again.

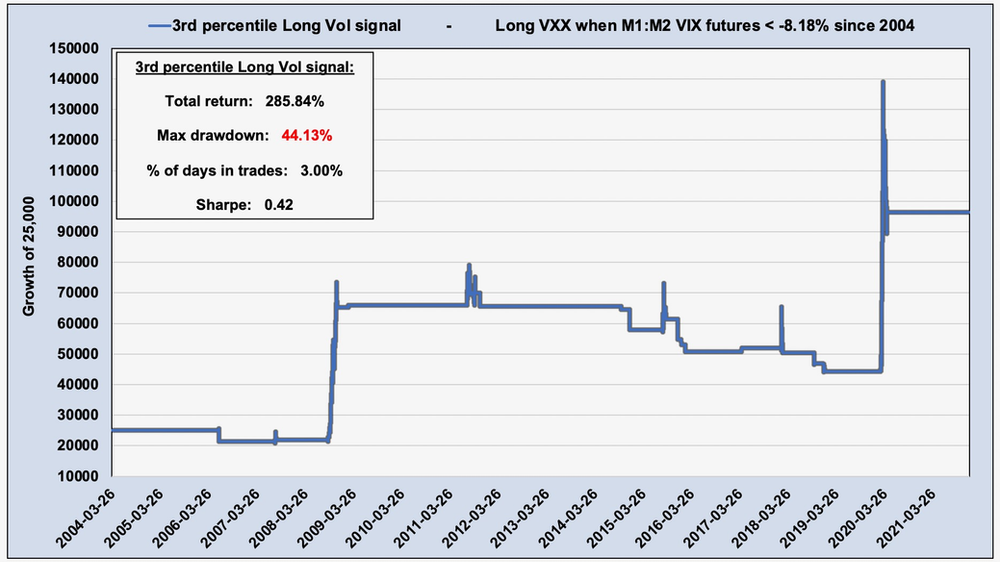

Long VXX when M1:M2 VIX futures within 3rd percentile

The 3rd percentile for M1:M2 VIX futures is -8.18% which is significantly in backwardation. Now it's worth noting that during this latest market crash in 2022, before today the most backwardation we've seen was around -4%. Using the 3rd percentile, no long volatility positions would have flagged yet. The Nasdaq would be off nearly -20% without a single long VXX signal. As I said, volatility metrics have been bizarrely calm during this latest mess.

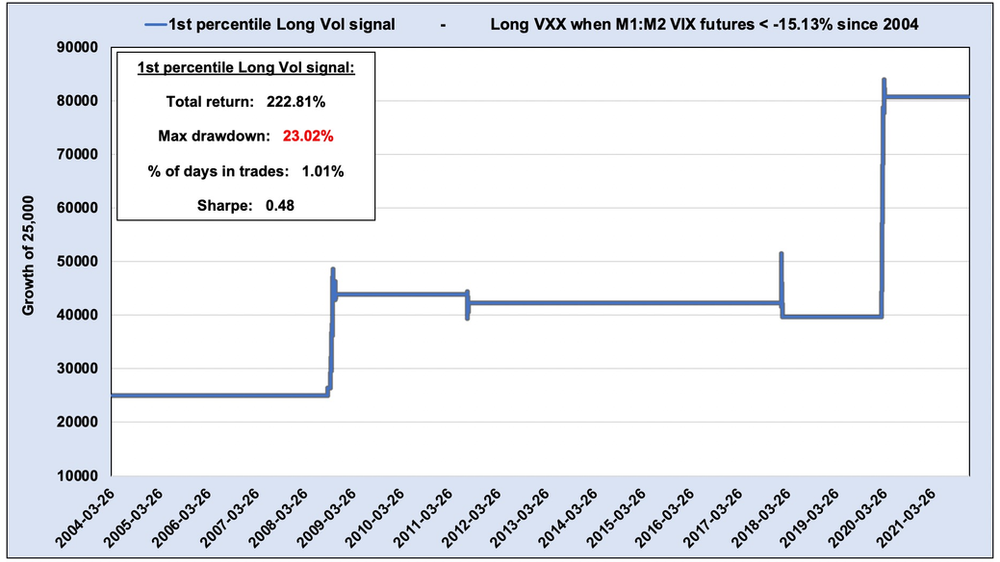

Long VXX when M1:M2 VIX futures within 1st percentile

For many traders this level of trade frequency scrutiny is just going to be too extreme. Waiting until the VIX futures are in backwardation by over -15.13% will likely mean that almost no signals ever flag. Only during the worst of the worst market crashes will their portfolio get any tail risk protection.

Now that might be fine if you're willing to wait 10 years to make a profit during only the deepest recessions, but for the vast majority of investors they will feel this is too restricting. I tend to agree. I personally believe that going forward the next several years, we could see more frequent crashes as the world grapples with the reality that the economy is in serious trouble. I for one don't mind introducing a little whipsaw to my portfolio in order to try to capitalize on some of those crashes.

* And of course, pursuing more robust volatility metrics that are more successful at timing the long volatility trade than simply the VIX futures by themselves is a worthwhile endeavour. Wink nod, check out the VTS Volatility Barometer.

Long Volatility is a notoriously difficult trade

Solving the giveback problem involves reducing trade frequency to the point where the major market crash signals still flag when needed, but the exit signals are also going to come sooner as well. Perhaps if the trader finds that goldilocks level, not too much, not too little, at that point long volatility positions will be worth the frustration.

Fair warning though, in my experience it doesn't matter how good you are at it, you're going to wake up to some very bad days when the news headlines cause everyone to think the world is fixed and the buy the dip crowd comes with vengeance. Those face ripping reversals when the trader is holding long volatility positions are so frustrating. They are part of the process for sure, but be careful not to have any breakables near your computer when you wake up to check the S&P futures in the morning if you know what I mean. I may or may not have dented a few walls throwing things in my 15 years as a volatility trader...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.