Here's what happens on VIX futures expiration day

Feb 12, 2019VTS Community,

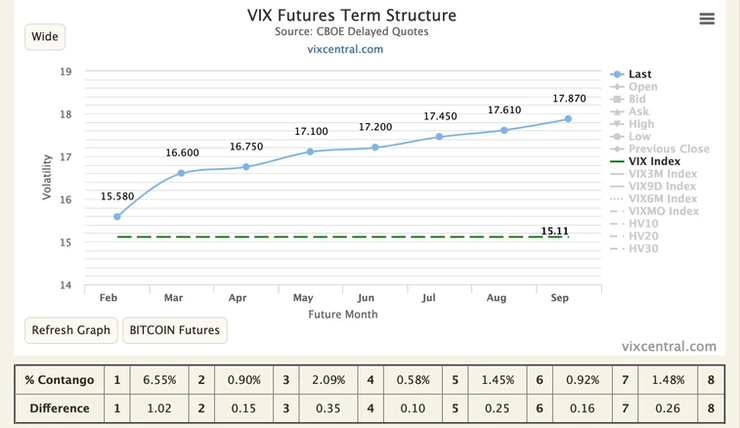

Today is a good opportunity to show everyone what happens to the VIX futures term structure curve around expiration. I have a video down below that explains it in more detail so you can watch that when you have a chance, but I'll also show the example using today's numbers. Here's the VIX futures curve this morning. Remember you can see this anytime by logging into VIXcentral.com

Now it's relatively flat right now which means the number value difference between the various contracts is quite small. Typically in a confident market the gap between them would be much larger, but the shape right now is more or less normal. It's upward sloping to the right, representing the condition called contango. Now because it's so flat, a single down day in the markets could easily push it into backwardation again so that's something to keep in mind for gauging the level of aggression traders will be shorting volatility right now. Essentially, there may not be much "meat on the bone" here to short, but that's for another day :)

For most of the main volatility ETPs such as SVXY, VXX, UVXY, TVIX, they derive their value based on a set method of holding a composition of the front two month VIX futures.

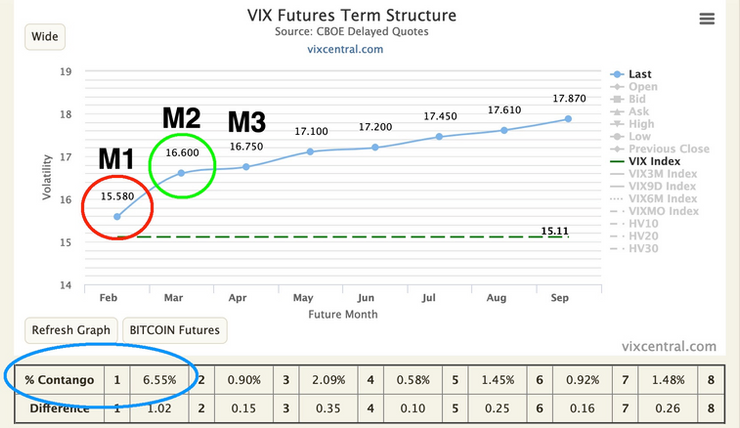

Let's take SVXY for example, which is an inverse volatility product essentially meaning it maintains net short exposure to the front two month VIX futures. Depending on how many days are left in the monthly trading cycle, it will be holding a certain percentage of the front month M1 and back month M2 contracts.

So on the first day of the monthly cycle it will be holding 100% of the front month future M1 and 0% of the back month future M2. As the days go by it will be shifting it's holdings away from the front month M1 and towards the back month M2. On the last day of expiration cycle (which is today) it will be holding roughly 95% the back month M2 and only one days worth or about 5% of the front month M1.

The level of contango shown right now is 6.55% (blue circle) which is very close to the long term average. 6.55% contango is the 52nd percentile of values since VIX futures launched in 2004.

However, at the end of trading today the front month M1 marked in the red circle will be off the board. The back month M2 marked in green will become the new M1, and the M3 will be the new M2.

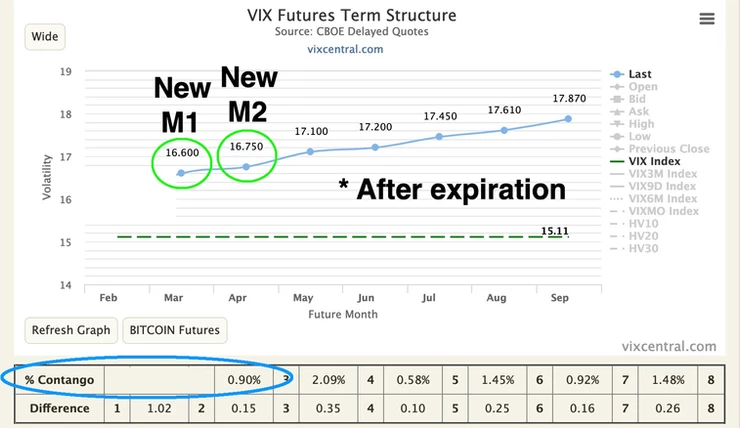

So take your thumb and cover up the red circle for M1 and you'll see an approximation for what the new curve will look like tomorrow assuming not much changes from now until then in the markets. Notice something? Those front two months will again be pretty flat right?

After expiration, the M2 will become the new M1 with a 100% weighting. M3 will become the new M2 with a 0% weighting. Then the cycle continues with volatility ETPs like SVXY holding a rolling composition of the new front month futures. Here it is visually with the front month deleted:

On the first day of the new expiration cycle (which is tomorrow) assuming not much changes, the level of contango we see may be closer to 0.90%. 0.90% contango is actually only the 21st percentile of values since VIX futures launched.

There's 2 things I want to stress here just so there's no confusion:

1) The VIX futures term structure is only one of many volatility metrics that people will want to understand and utilize in their trading. But you can see how important it is to understand how it works right?

It would be easy to assume that VIX futures contango is pretty normal right now around the 50th percentile, but in actual fact it's quite low and closer to the 20th percentile.

If it's being used as an input metric, which for most traders it will be at least in some capacity, using the more accurate number will yield better long term results.

2) There is no abrupt changes to the values of any of the volatility ETPs. Sometimes when I explain this process to people they assume they can just short the futures the day before expiration and capitalize on this somehow.

Actually it's a constant rolling combination of futures so there is zero edge in trading expiration as it were. This is just a technicality and won't have any effect on the vol ETPs. It's just a process that's important to understand what the true level of contango actually is.

Here's a full video explanation as well. Follow up questions are always welcome. [email protected]

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.