I'm not a bull or a bear - I manage risk and trade the market we have

Feb 27, 2020This latest stock market crash has yet again brought one fundamental truism of investing into the light. It's something that really should go without saying, but since we humans are emotional and often times irrational creatures we sometimes forget:

It's just not possible to catch every market rally and avoid every crash

1) There are "permabears" out there who have been warning for years about the next market crash that's just around the corner. With them it's always run for the hills because the debt, the Fed, the dollar, the manipulation, the economy, the virus etc. There's always a reason to be on the sidelines. No doubt they are extremely happy right about now given the crash currently underway in the S&P 500. They were right this week and are happy, but what about the last 10 years? Many of the most famous fund managers are down substantial double digits over the last several years, and still managing billions by the way. 2) There are "permabulls" out there who hold stocks long and strong through everything, just buy and hold with confidence that in the long run the stock market goes up. And since the average recession cycle in the United States is about 6-7 years, most of the time they are right it does go up. So maybe they've made 10%+ CAGR over the last decade because of that buy and hold attitude, but how much of their spoils will they give back when the next recession eats away at years of that growth? Let's not forget, when adjusted for inflation it took the S&P 500 about 6 years to recover from the last crash. Being bearish only works once every 6-7 years on average, and being bullish dooms someone to give back half their gains every recession and be in a multi year drawdown. Since it's impossible to have it both ways, decisions / sacrifices have to be made. What are investors to do?

* Don't forget to follow me on Twitter

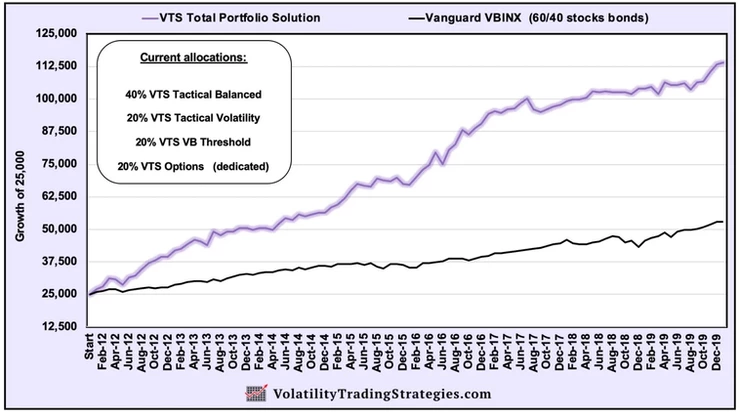

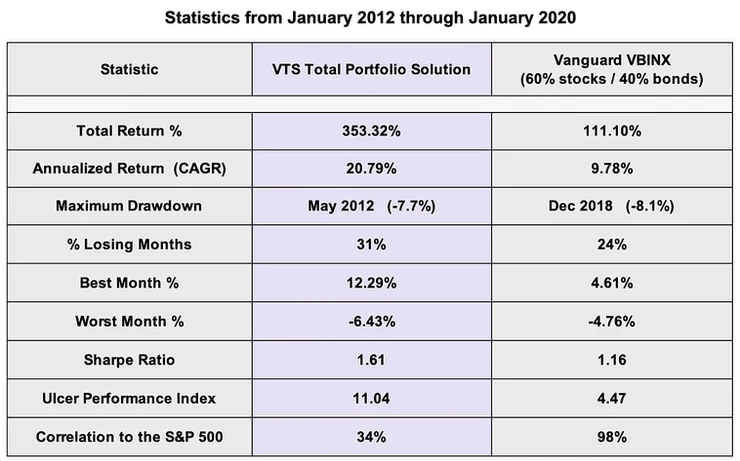

VTS Total Portfolio Solution plays the middle ground

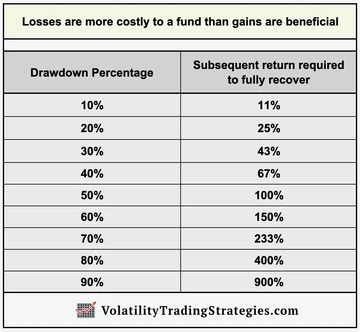

I try to capture some of the gains when the market is going up, and avoid some of the downside when it's crashing. I believe (and my track record backs up my assertion) that this is the best way to get the most consistent and impressive long-term rate of return. By carefully analyzing volatility metrics and using them as early warning signs of potential risk, I'm able to exit trades either before crashes even start, or at least before any major damage is done. And remember the math on drawdowns. The larger they are, it requires exponentially larger gains to recover to break even.

Because I'm conservative in nature, when viewed in the short-run over a few months or even a year, it's not always obvious what I'm doing or why I'm doing it. I do occasionally get people ask why we're not participating in something that is going up in the short term. Why aren't you short vol right now when the VXX is going down? Why aren't you holding stocks? Why aren't you leveraged? But when viewed in the medium to long-term it becomes pretty clear why I do what I do.

And I'm very confident in saying, in the midst of the next full on recession it's going to be as clear as day! A day will come, maybe soon, maybe not for several years, but a day will come when it's as obvious as could be that avoiding drawdowns really was the best course of action. Nobody can catch every uptrend and avoid every downtrend, but I strongly believe that if we trim a little bit off both ends of that, it adds up to a great compounding rate of return over an investing lifetime.

Investing is not a sprint, it's a marathon

1-2 years of good results don't do much in the grand scheme of things. To succeed, we need to do well for 20-30 years or longer. VTS launched 8 years ago and we're off to a pretty good start, only 20 years more to go...

I guess the big question now is, when will that next ugly recession actually be? Is this the start of the big one, or will this "dip" be bought with force? Fortunately for me since my volatility metrics and the VTS Volatility Dashboard guide my trades, I have the luxury of not having to guess. I'll just take what comes and be ready for anything. Right now, we're in defense mode because WOW!

PS: VTS Total Portfolio Solution is about flat for February, so another successful dodge :)

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.