Q4 2018 Strategy Report - Volatility Trading Strategies

Feb 19, 2019VTS community,

2018 was the first negative year for the stock market since 2008, so needless to say it was a rough one for most investors. For those who like video format, I have a short one here discussing some benchmark performance as well as my own in 2018 so please enjoy, and feel free to ask any follow up questions.

* The written report is below the video *

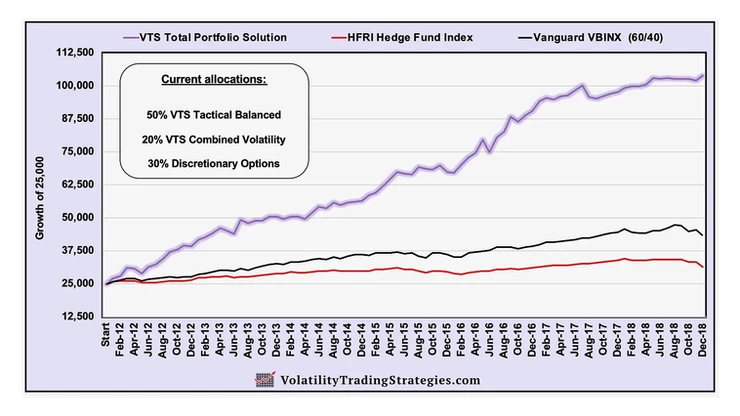

With the S&P 500 suffering a -20% drawdown in the 4th quarter of 2018, the fact that the Total Portfolio Solution was profitable with almost no drawdown may make it one of the more successful quarters thus far. The absolute number doesn't sound all that impressive, but with investing all that matters is relative performance.

To me the single most valuable component of any long term investing strategy is the ability to reduce drawdowns.

As the old saying goes, everyone is a genius in a bull market.

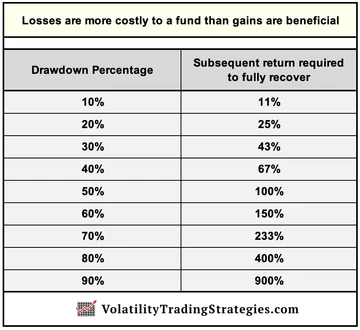

It's true, when everything is cooperating there's plenty of ways to make a profit. So it's not lack of performance during good times that leaves investor portfolio's struggling long term. It's actually the drawdowns during bad times that costs them the most. Remember the math involved in recovering from drawdowns. It actually takes a progressively higher rate of return to recover from larger drawdowns.

You can see in the chart, it takes a 25% return to recover from a -20% drawdown. So when the stock market is down -20% in a quarter, the first and most important step is to reduce that drawdown significantly. Beyond that, it would also be an added bonus to actually make a little profit as well. That's the real holy grail of investing.

So like I said, the actual return last quarter of 1.27% doesn't sound that great, but compared to the alternative I'm certainly not complaining. And remember, at some point the markets are going to go into a recession. Maybe this year, maybe not for a few years, but eventually it's going to happen. When it does, the drawdown won't stop at -20%. It may go to -40% or worse, who knows.

Now would be a very good time to check your portfolio and see just how correlated to the S&P 500 you really are. If Q4 2018 was a rough one for you, my humble suggestion would be to take action and fix that problem now, before the next recession.

As long time followers of mine will know, my focus is on smoothing out performance and providing the best rate of return possible while still maintaining a relatively low stress level. Despite the market throwing two significant drawdowns at investors (February and Q4) the Total Portfolio Solution still managed a solid rate of return with only a -0.99% drawdown for the entire year. I consider that a big win!

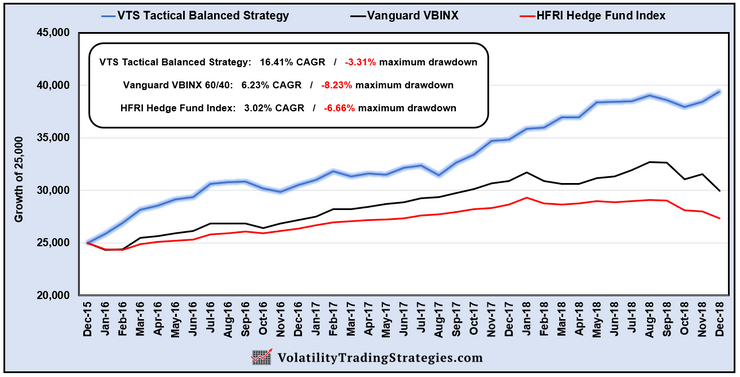

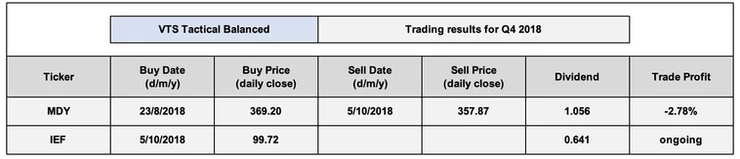

Another very solid year for the "core" portfolio position, the Tactical Balanced Strategy. In my opinion having a solid core position that performs well in both good times and bad is vital to long-term success. With that in place, it means investors can allocate smaller portions of their portfolio to higher growth strategies. That wouldn't be possible if the core position crashes every time the markets do. In my mind, the idea of having the core position in the stock market like so many investors out there do is ill advised, considering it crashes on average -51% during recessions.

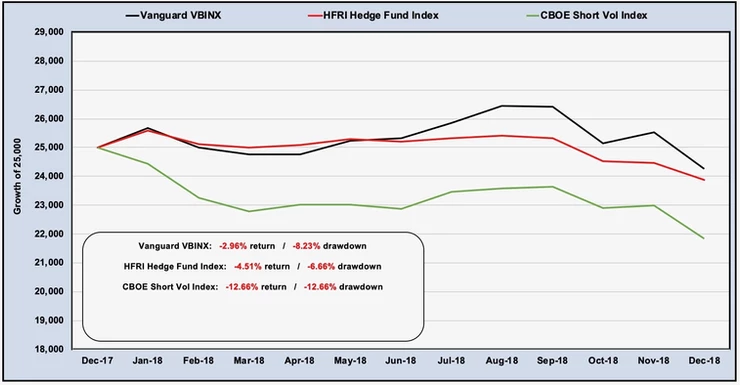

3-year trailing strategy results vs benchmarks:

Not only has the Tactical Balanced Strategy handily beat it's benchmarks, but it's done so with substantially lower drawdowns. Higher return, and lower volatility, that's what it's designed to do. Of course no strategy catches every market uptrend or avoids all downtrends, but this strategy is in my opinion about as good as it gets for a core portfolio position. The Tactical Balanced strategy is the reason I'm so confident allocating towards volatility ETPs and options trading.

I do trade all my strategies independent of each other, but in a sense, they all depend on the stability of the core Tactical Balanced Strategy.

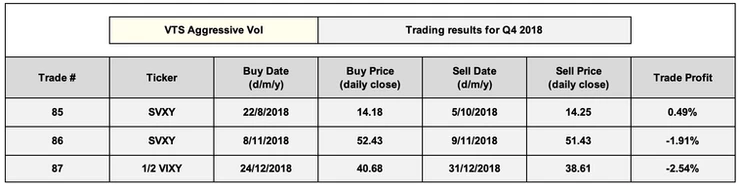

It's a sad day my friends, but I suppose it had to happen at some point. I've been trading volatility ETPs for over 8 years now. You can see a small sampling of my first "active" month trading these vol ETPs in this video here. I started with VXX before any of the inverse products even existed and have grown with the volatility space to now include the full spectrum of them. VXX, SVXY, ZIV, VXZ, and options on VXX and UVXY, they are all represented by the family of volatility strategies.

Well 8 1/2 years in, and I did finally have a negative year. Just a small dip, but negative none the less.

It's my policy to never brag about good performance, or make excuses for poor performance, so the one thing I don't want to do in this situation is sound like I'm trying to justify why a -8% return in 2018 was still pretty good. It was negative, which is below the high standards I place on myself, full stop.

But we can't really do a performance report without talking about what type of year it was for the volatility complex, so without excuses, here we go. There are several benchmarks that could be used with respect to volatility trading. The two that I feel are the best though are:

1) Short VXX when the VIX futures term structure is in backwardation

2) The CBOE Eurekahedge Short Volatility Index

An average of those two benchmarks would give an accurate representation of what the majority of volatility traders experienced in any given year. So here's what both of those looked like in 2018:

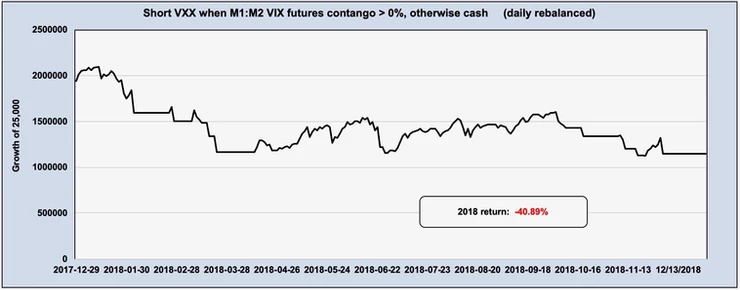

Short VXX during days of contango only:

CBOE Eurekahedge Short Volatility Index (in green)

So combining the two benchmarks, objectively speaking, a rate of return around -25% give or take would be the norm for 2018. It was a tough year to trade volatility because there were two substantial drawdowns in the same year, meaning volatility remained on edge throughout.

The first drawdown was the now infamous "Volmageddon" in February that unfortunately terminated our old friend the XIV, and also forced ProShares to reduce the leverage factor of SVXY to 0.5x. So despite the fact that I was in cash and didn't suffer any losses, February 5th, 2018 did affect a few things in the volatility complex. The second was the -20% S&P 500 crash in the 4th quarter. All in all, there wasn't much relief for the volatility markets.

There are two components to successfully navigating the volatility allocations within a portfolio. Reducing drawdowns is the most important because of how quickly losses can accrue if traded too aggressively. And secondarily, increasing the rate of return because they are meant to be higher growth strategies. In most years I've managed to do both get a great rate of return and keep drawdowns to a minimum.

In 2018 though, unfortunately, I was only able to manage the drawdown reduction component.

Drawdowns were reduced substantially, but with no periods of gains it ended up just being a slow steady bleed of capital to a total of -8.7% for the year. Much better than the benchmarks, but well below my own standards.

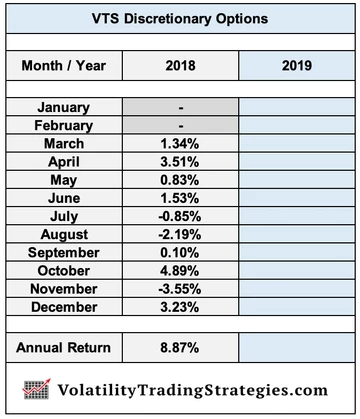

Discretionary Options Strategy

The thing I love most about options trading is the versatility. We are restricted only by our imagination and understanding of the underlying math. It's easy to structure options trades that range from pure long to pure short, and everything else in between. We can adjust the leverage factor to be more or less aggressive, and we can also structure trades to directly capture volatility movements which isn't possible any other way.

And what all this adds up to is the ability to profit during any market environment. There's no restriction to be correlated to the underlying market.

That's why in a year where the stock market was negative, and down -20% in the 4th quarter, I was still able to structure enough profitable trades to reduce that drawdown and avoid allowing the year to derail forward progress.

I realize options trading is new to many people, and it can be quite intimidating. But I assure you, it's worth the effort. In this late stage of the bull market, diversifying away from strategies that are highly correlated to the stock market is a very good idea.

In my daily blogs sent out to the VTS Community, I break down the mechanics of every options trade taken in a daily blog and explain all the risk management that will be used throughout the trade. It's not as difficult as it sounds.

Feel free to open up a paper trading account and follow along with the options trades. Ask as many questions as you want, I'll help you every step of the way. And when you're comfortable, you can start taking small real money allocations, diversify your portfolio and learn this very valuable skill.

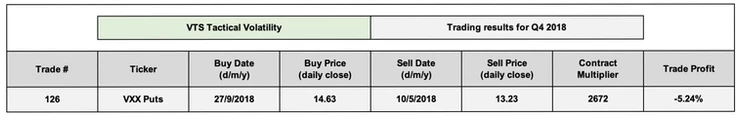

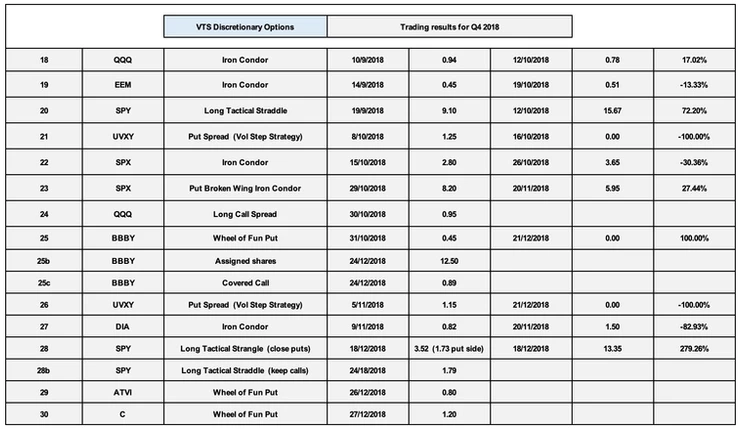

Trade history in Q4 for all strategies

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.