The REAL cost of financial advisors

Sep 16, 2024

VTS Community,

How much does a financial advisor REALLY cost?

I'll be making a more detailed video down the road comparing the long-term difference between paying a financial advisor vs paying a flat subscription fee. Now sure, it's a little self serving because obviously a flat fee with VTS is far cheaper long-term (and with a much higher return), but just because it's self serving doesn't mean it's not true. The difference between them will surprise you just how much it matters, but we'll leave that for the extended video. Today, let me share some of that intermediate data today and put a number on the cost of financial advisors.

What rate of return do advisors get?

Recall from last week, I compared several benchmarks and showed that the long-term expected rate of return of asset managers, hedge fund managers etc, is roughly in the 5-7% range since January 2012.

Given that this is all during a mostly bull market since 2012, we have to expect at some point there will be an extended recession that pushes the numbers down lower. Somewhere in the 5-6% range is far more accurate.

Also worth noting, that's with perfect discipline to just stay the course and keep fully invested. Given the mine field of emotional and cognitive biases investors suffer from (especially during a crisis) it's likely they will make a few poor decisions along the way and turn that 5-6% into 2-3%.

* Let's lean on the very high end and use 7% CAGR for our example

What are the average fees for financial advisors?

In the last several years we have definitely seen an overall downward adjustment of fees the average financial advisor charges. It used to be fairly common for advisors to charge around 2%, but these days it's closer to 1% which does scale with the total asset base.

If for example you have a few hundred thousand dollars or less then the fees could definitely be higher than 1% and could still be 1.5% or so. If you're in the 1 million range then it'll likely be around 1%. If you had 2-3 million or even higher then it'll probably scale closer to 0.8% or so.

* Let's be as generous as possible and use 1% / year

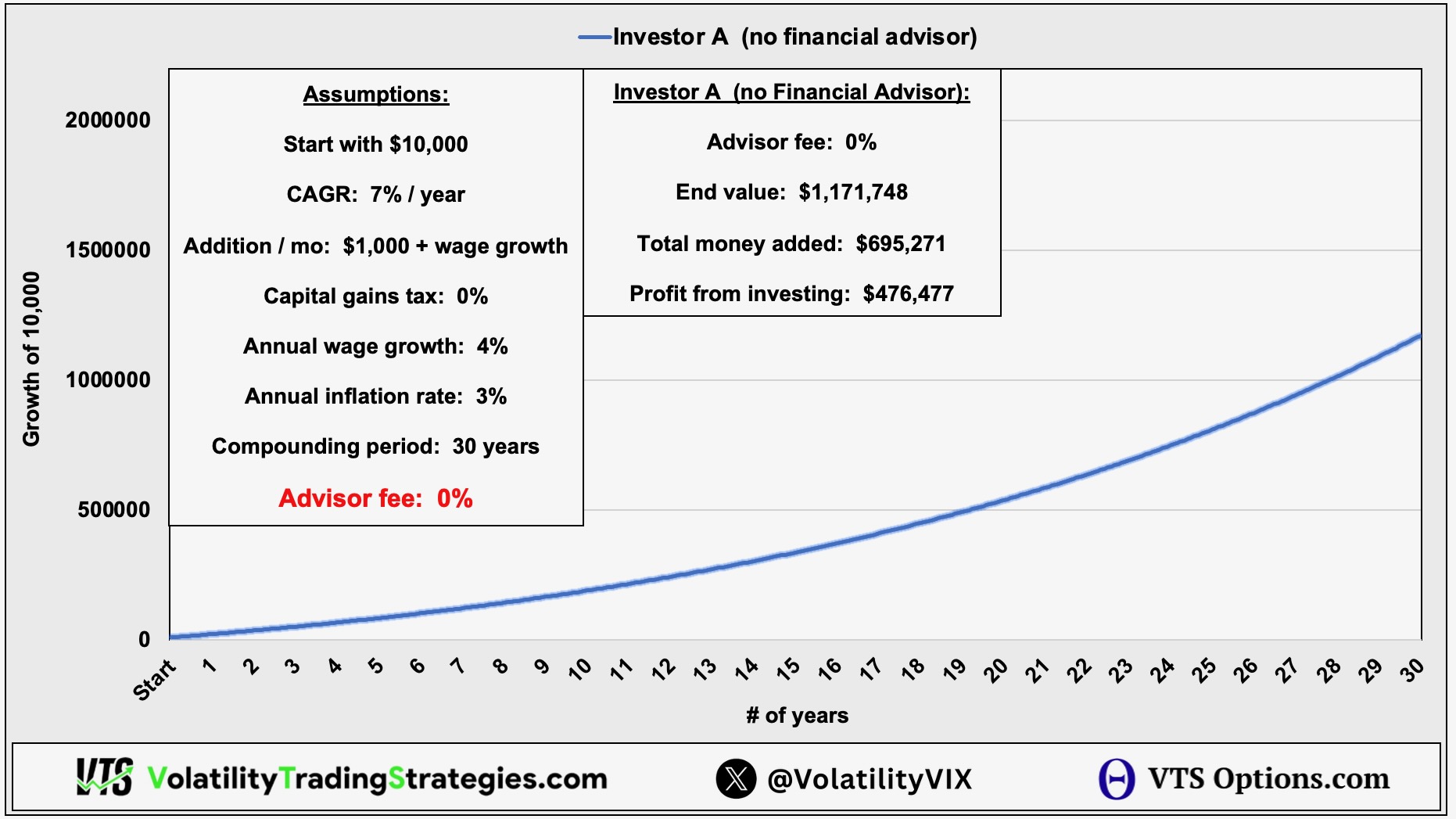

Baseline investor who does NOT use a financial advisor

We're comparing a self directed investor that feels confident they can take the reigns of their own investment account and manage it adequately, vs an investor who decides to pay 1% of their assets every year to have the guidance of a professional advisor.

First, we need the baseline assumptions:

Start value: 10,000

Annual return: 7%

Monthly addition: 1,000 + wage growth

Capital gains tax: 0%

Annual wage growth: 4%

Annual inflation rate: 3%

Compounding period: 30 years

Advisor fee: 0%

So at first glance it may look reasonably impressive. Starting with 10,000 and adding 1,000 + wage growth, they will end up with nearly 1.2 million dollars at the end of 30 years.

Digging into the numbers closer though, we do have to factor in that 695,271 of that final value was simply money the investor added to the account themselves. That doesn't count as "investing growth" so the real value added due to investing was 476,477

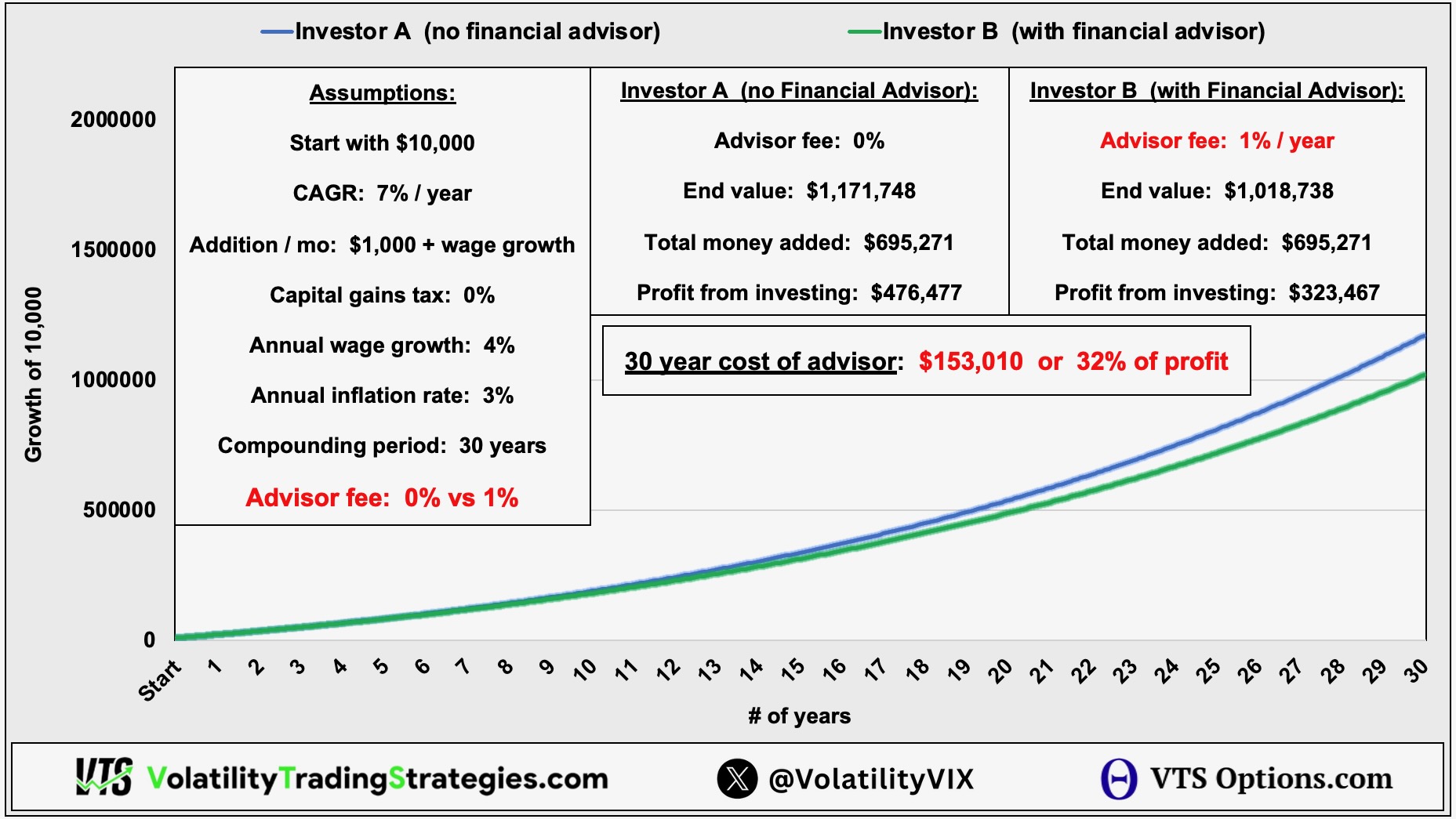

Investor who pays 1% to a financial advisor

We'll use the exact same assumptions as before, with the only change being that we're adding a 1% annual fee.

* Advisor will typically charge quarterly so the impact would even be a little higher, but I'm just using a once annual 1% fee here for simplicity.

Again, on first glance people might think this is still ok. After all, the investor will still have a million dollars after 30 years.

However, backing out the 695,271 that was simply the money they added to the account themselves and we are only left with an investing profit of 323,467

Compare that to the profit of 476,477 the self directed investor earned through investing activities and the difference is actually quite impactful.

30 year actual cost of the advisor: 153,010 or 32%

A measly 1% fee to a professional advisor doesn't sound like that big of a deal. However, when we run the numbers on it we realize that even a modest advisor fee is going to cost them about 1/3 of their long-term profit.

The picture also becomes exponentially more grim when you factor in that anybody can build their own buy & hold portfolio and perform just as well as the advisor that's costing them 1/3 of their money. If an investor was satisfied with a 7% long-term return, they can get that themselves and not participate in financing the advisors summer home in the Hamptons.

Who should consider paying an advisor?

In my humble opinion the only people who should ever be paying money to professional advisors of any kind (including myself) are people that fall into one of three categories, or perhaps a few of them:

1) They want a higher than 7% return. A buy & hold portfolio, even one that includes dollar cost averaging or dividends, when factoring both bull and bear markets will likely not yield more than 7% a year long-term. To be honest, given that stocks are near all time highs and the 35 year bond bull market of the past is over, it's likely going to be worse than 7%. In order to beat that, you will have to pay someone with a track record of outperforming the market to assist you. I will stress though, a proven track record, not just someone who makes claims on social media.

2) They don't trust themselves to be able to remain consistent. Investing is hard, and when emotions run hot during a market decline, many investors simply don't have the discipline to stay the course. They will most likely make poor decisions in a crisis that will cost them significant amounts of their capital. Paying someone who has more experience dealing with difficult situations may still be worth the cost, considering the alternative.

3) They have a very complex and dynamic financial situation. For the vast majority of people this won't apply. If you're just married with a couple kids, semi-normal jobs and your life doesn't radically change every few years, then your financial plan will only require small tweaks here and there every few years. If however you have a very complex business structure, or your family situation is abnormally complex, then perhaps it would be worth it to pay someone that fully understands your changing structure and can grow with you over the years to guide you into the most efficient decisions.

However, if you're a person who is reasonably disciplined and happy with just getting a 3-4% return over the inflation rate, you can definitely do that yourself without paying an advisor 1/3 of your asset base over 30 years.

My goal is providing a higher return with lower fees

The self serving part will come later with the video when I compare the difference between a 1% advisor fee vs 1,000$ a year flat subscription fee. You'll wonder how the financial advisor gig is as popular as it is. You may wonder, why the hell does anybody pay these guys that much money for so little value?

On that point, we agree :)

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.