Volatility ETF Trading Strategies - Part 5: VIX : VXV

Nov 05, 2013* I’ll update the charts and commentary in these very old articles every now and then so that the data is stretched over longer periods of time. Last updated Nov 2015 *

In this series of five posts I’m going to be going into a little more detail about some of the most common methods of trading the various volatility ETP’s such as XIV and VXZ. I think it’s important that subscribers in the VTS community at least have a basic understanding of the complexity of these products as well as some of the potential drivers of possible strategies. The five part series will cover:

- VIX Futures Term Structure

- Volatility Risk Premium (VRP)

- Mean Reversion

- 30-day Constant Maturity

- VIX : VXV Ratio

Part 5: VIX : VXV Ratio

If you’re a trader and you aren’t familiar with the VIX index I suggest you dedicate some time to learning about it because it can be an important indicator regardless of the style of trading you do. Even in equities or fixed income trading it has it’s uses. It’s a statistic of forward 30-day implied volatility derived from a calculation of options activity on the S&P 500. However there is also an index very similar to the VIX that few people are aware of and that’s called VXV. It’s essentially the same thing but it represents a 90-day forward look at implied volatility.

-

If the 30-day VIX is lower than the 90-day VXV it should provide a tailwind for the XIV as front month futures converge into expiry

-

If the 30-day VIX is higher than the 90-day VXV it should provide a tailwind for VXZ as front month futures converge into expiry

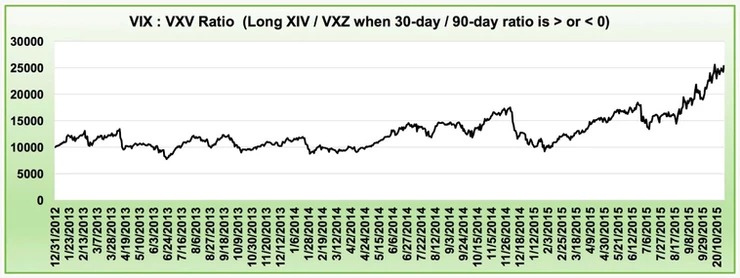

Here are the results of this simplified VIX : VXV Ratio system:

It’s been fairly consistent compared to other indicators and it’s certainly taken off in 2015, but I suspect that’s more due to the nature of the markets this year rather than the robustness of the signal itself. On it’s own it’s fairly meaningless, but it can be one of several potential indicators that may shape the way people trade volatility products. I use this index myself, as well as a few others that are very similar but just over different time periods.

As always for reference, here is our results over the same time frame:

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.