Ignore short term noise - Focus on the long-term process

Nov 13, 2020I want to state from the outset here, this is going to seem incredibly self serving today. I'm essentially going to be cheerleading my style of investing in this article.

Now hopefully you can forgive me today as I very rarely do this. I really don't do very much marketing or self promotion at all. I don't brag when the portfolio does well, and I don't make excuses when it doesn't, I don't feel like I need to. I have the utmost confidence that both the portfolio performance and the number of people who follow my work will continue to grow. I'll leave the marketing to the Twitter guru's, I just do the work!

Today I want to talk about the importance of trusting the long term process and that in itself is going to seem self serving. Apologies, but it's a very important subject.

New subscribers often ask me how I've navigated difficult market periods so well. They really don't understand it as so few people out there can do it. The vast majority of investors have their fortunes tied directly to the ebb and flow of the stock market. If stocks are up, they're happy. If they are down, so is their portfolio. Virtually all of the asset management industry follows this pattern.

We don't do that at VTS. For me, I aim to keep the correlation to the stock market low, so that the regular ups and downs of the stock market (and occasional crashes) don't affect us very much.

I don't think anybody could argue that I haven't crushed the market in the last 9 years since I launched VTS. Roughly 20% annualized return with portfolio drawdowns no higher than mid single digits.

But actually, we have losing trades ALL the time!

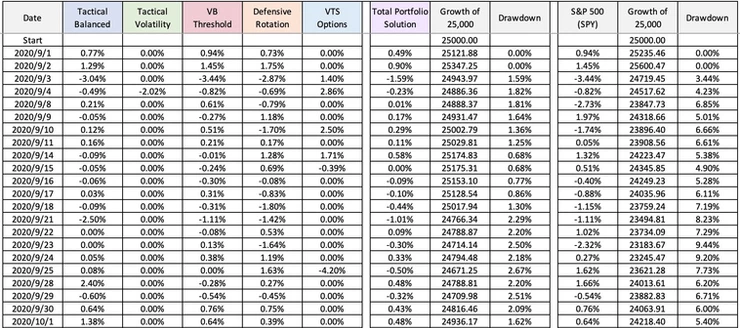

Just in the last 2.5 months, here's a short list of trades that didn't go well for us at all since the beginning of September:

- Entered MDY on Sep 18: Lost 2.5% the next day

- Entered SPY on Sep 18: Lost 1.11% the next day

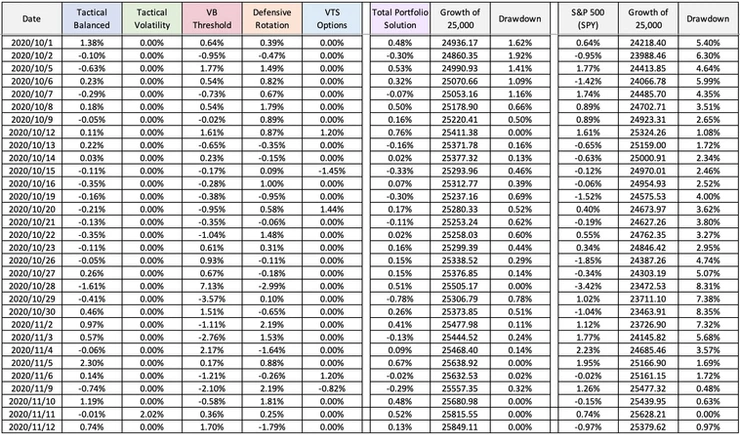

- Entered GLD on Oct 15: Lost 0.35% the next day

- Entered IEF on Nov 6: Lost 0.74% the next day

- We also had a short volatility VXX trade that was up as high as +8.3% before reversing and ending up losing -2% in the end.

- And we had a long volatility VXX trade that was up over 7% within 1 day, and ended up a few days later to be barely profitable.

The point is, we have losing trades ALL the time!

Now I don't mean to be dismissive about losing trades because there are emotions involved with them, but honestly, so what? Isn't all the matters the long term growth of the entire portfolio? If I focused on every losing trade i'd go crazy. It would make me hesitant to take new trades, and I'd likely abandon the process. And clearly given the success of the portfolio, abandoning the process would be costly.

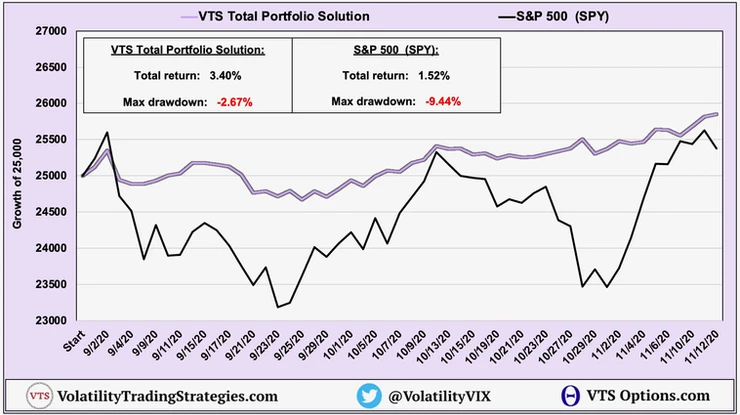

So I just highlighted 6 trades that went poorly just in a 2.5 month stretch right? But here's the performance of the entire portfolio over that same time period of 2.5 months:

It's much harder to see the losing trades isn't it? Where are they? If I'm being honest, I had to go through the performance record because I've honestly forgotten where they happened. They don't matter!

Each strategy is traded independently of each other, and the whole portfolio is designed to be diversified. So if and when losing trades happen (and they will, all the time) hopefully the rest of the portfolio is doing its job and covering up for some of it. That's how it's designed to work.

Despite having several disappointing individual trades, in the last 2.5 months the Total Portfolio Solution is up 3.4% with a max drawdown of just -2.67%. Bear in mind that the stock market has been crazy volatile over that same time period, TWICE suffering drawdowns of -9.44% and -8.35%.

VTS just keeps cruising along without much stress.

That is how I have managed to avoid every market drawdown in the last 9 years. By NOT focusing on the individual losing trades. I step back and look at the big picture, only focusing on the long term process and the entire portfolio, and it has served me very well.

The subscription model is great, except for....

There are many advantages to the subscription service model that I have chosen, and I will do a video soon talking about all the reasons why I personally prefer it over traditional asset management.

But there's one obvious downside: The ease at which people can abandon the process.

In the click of a button they can stop, and I don't think it's any coincidence at all that the times I notice people unsubscribing is the day after one of those horribly timed trades. You know the ones. We move into a position only to see it fail the very next day. Believe me, I hate when that happens as well. And from the subscribers perspective, it makes it appear like the portfolio isn't working. Remember, it's a cognitive bias that our brains will naturally focus in on the negative.

But it's definitely worth asking the question: Would you even have noticed it if someone else was managing your trades?

With traditional asset management, you won't notice any of the day to day individual losing trades. In fact, you won't even know what those trades were, and you probably won't even really understand the overall investing philosophy of your advisor.

With the subscription model, when you're executing trades yourself, you'll see every one of them!

Fundamentally I think this is the main reason why so many people stay invested with their financial advisors, despite the vast majority of them having abysmal performance. It's because they don't see the day to day. They just take a meeting a few times a year.

Advisor: "How's the golf game? How's your wife? Kids good?"

Client: "Yeah great, thanks for asking, all good on the family front. How's the portfolio doing?"

Advisor: "Well it's been a rough stretch for the stock market, the portfolio is down. But I expect things to pick up again in the next quarter. We'll just stay the course, things will improve soon"

Client: "Ok, hopefully. See you in 6 months."

That's about how it goes, and long term the client gets a terrible rate of return because it's just following a pie chart of correlated assets that at best will return low single digits.

I strive to give anybody who's open to it a much better way to invest. I've proved this for 9 years, and I plan on doing it for a few more decades. But the catch is, you'll have to have the discipline to focus on the long term process. The fact of the matter is, it's impossible for the individual strategies to avoid losing trades. They happen, a lot!

But when viewed from 30,000 feet in the long term, I don't think there's anything better. Self serving I know, but putting my normal humble nature aside for just today, I think it's objectively true :)

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.