Gold at all time highs - Is it still safe to hold?

Apr 17, 2025

Is Gold at all time highs still safe?

For anybody who's been paying attention to the markets lately I would say besides the self inflicted wound of crushing the US economy through punitive tariffs, the big standout story has to be the performance of Gold.

For context, this is a 20 year chart:

As we can see, gold isn't exactly a consistent asset class. Performance was outstanding before and during the financial crisis, but then it really struggled up to 2015. It had another nice run from 2018 up through Covid in 2020, and then again pretty flat for a few years.

In the last year it's gone parabolic which has been very nice since we've also held GLD Gold in our Tactical Volatility Strategy as a safety position way more than normal and have benefited very nicely from this rise.

It's the type of move though that makes it completely natural to start questioning whether it's even safe to hold anymore. Could it really keep going higher or is a crash imminent?

We only hold gold 1/3 of the time

The big question from our perspective as tactical investors isn't whether gold will continue to go up. The only question that matters for us is:

Will gold continue to go up when we hold it?

Since inception in January 2012 the Tactical Volatility Strategy has been in safety positions 37% of the time. What gold does the other 63% of the time doesn't affect us at all. We only hold Gold during elevated Volatility when it's too risky to be shorting Volatility.

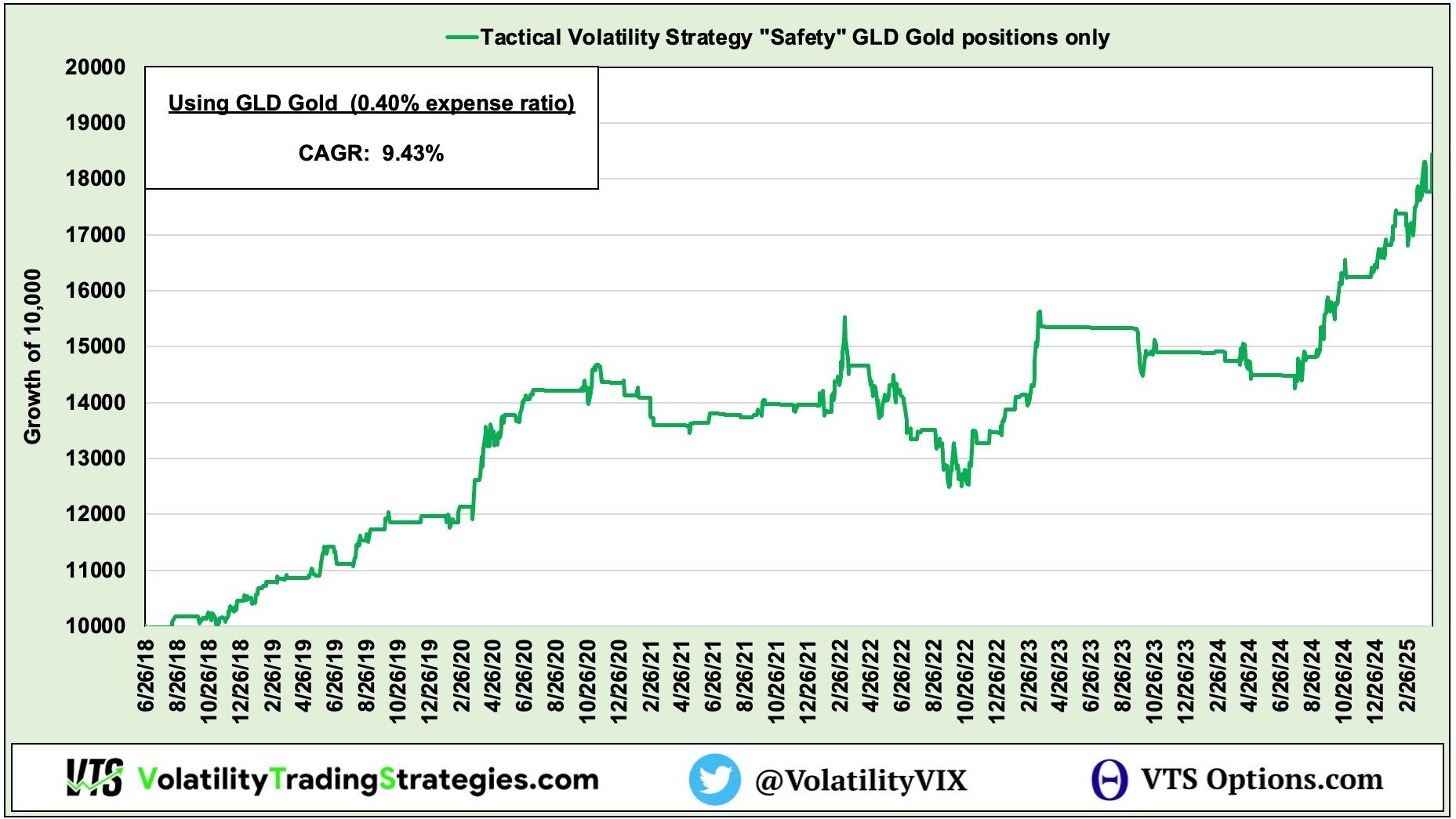

GLD Gold positions ONLY since January 2012:

When we isolate only those days holding Gold my conclusion is, a nearly 7% annual return on only 37% of trading days is exceptional performance that I would gladly take if it was offered for the next 13 years as well.

What makes it even better though is that these 37% of trading days are the ambiguous difficult periods in the market where most investors are struggling. It's the one-two punch of both a great return, and at the exact time you want it most.

We don't need to underperform if Gold does

Obviously I don't have a crystal ball to see the future path of gold, but I will say that performance chart above does give me a lot of confidence that at the very least, gold should perform reasonably well at the times that we would be holding it.

The reality of the investment world is, people do rotate capital around between asset classes, but they very rarely shift into all out cash. Large institutions especially are not in the practice of moving clients to Cash because of course that would mean they aren't getting paid nearly the fees they would be if they just moved capital around.

There are very few asset classes that offer any protection when equities are struggling. Treasuries maybe, Utilities are good as well which we use in our Defensive Rotation Strategy, but Gold is also on that short list. It has long been a default safety position during times of uncertainty.

2025 seems to be the very definition of uncertainty

While it's definitely possible we're in for some rocky times and larger day to day fluctuations in the price of Gold, I am still confident that the overall status of safety still applies.

I'm going to follow our systematic signals, knowing there could be some bad days in the Gold market to come.

Short Volatility crushed! Gold to the rescue

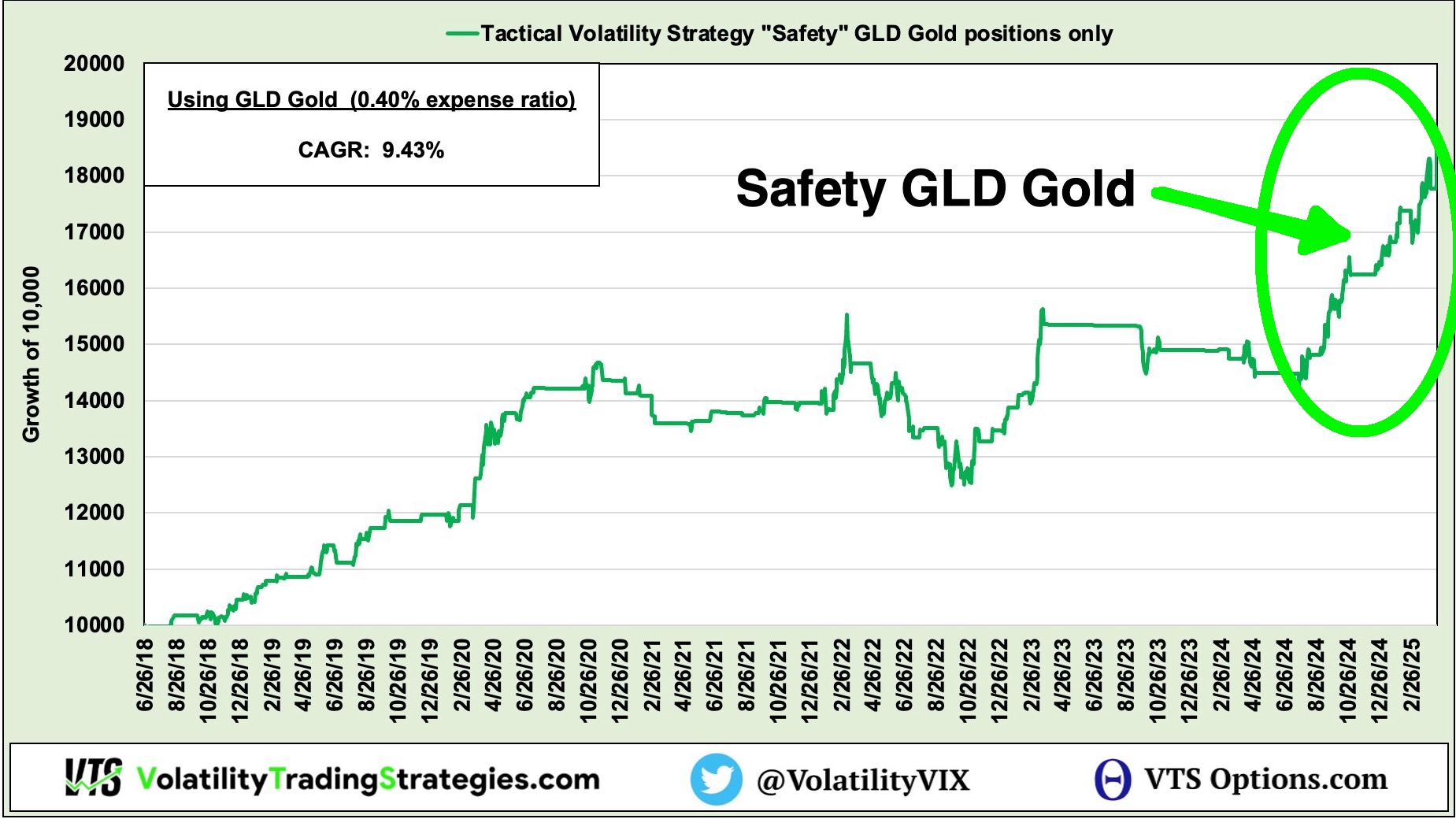

Just as a point of reference, here's the performance of our GLD Gold positions since it's caught it's second wind the last 7 years:

Again it's been a slam dunk as far as getting great performance at the time when we need it most.

What's even more relevant is the performance just in the last year. Starting July 2024 the Short Volatility trade (SVXY) has been absolutely crushed. It's nearly been cut in half with a roughly 50% drawdown

Our Tactical Volatility Strategy though is basically flat performance wise in that same time period. How did our "Short Vol" strategy not lose any money when the SVXY itself is down almost 50%?

GOLD!

It's not the worlds sexiest asset class, and I would never buy & hold Gold. The long-term performance is just too inconsistent for that.

But as a pure safety position on 37% of the risky days, GLD Gold has been exceptional and I will continue to trust in the shiny pet rock.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.