Intraday stock prices are random noise

Apr 15, 2025VTS Community,

Intraday Stock / ETF pricing is unpredictable noise

One of the most common questions I get from VTS subscribers is, "What time of day is best to execute the trades?"

I gather my data roughly an hour after the markets open because it can take about that long for the initial bout of early Volatility to settle down, and then I put it all in the email and send out the official trade signals to the VTS Community around 11:15 am Eastern Time give or take.

That essentially gives subscribers a 4-5 hour window to execute trades. I always say, it's very important that people enter and exit the same trades on the same days. Waiting even 1 day can cause some problems if the market moves a lot so same day entry and exit is important.

However, there is no "best time" during that same day

We all have busy lives. You may have a job that makes it difficult for you to get away at the time of the email, or maybe hobbies during the day, kids to take care of. Whatever your typical day looks like, you'll have that 4-5 hour window to execute trades and you can do it at any time.

I have no data that shows noon is any better than market close, or 2:00 pm is any better than either of them. From my perspective it's all going to average out to the same long-term.

Some days you'll get a better price, and other days a worse one

Law of large numbers

The law of large numbers means that over time with a larger number of occurrences it will all average out to a very similar result. In the short-term however over a single trade there can be significant differences in intraday pricing. I want to highlight two of those days to illustrate my point.

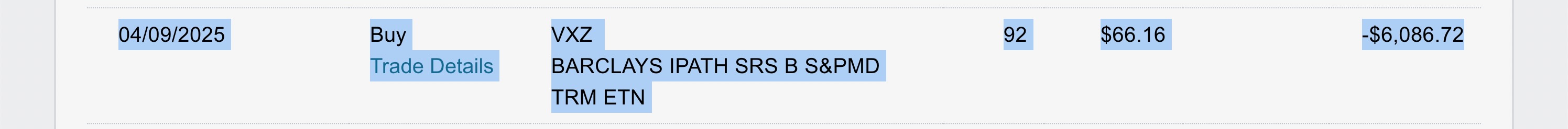

Example 1) April 9th, 2025 we entered VXZ

I sent out the email around 11:15 am to buy VXZ in our Tactical Volatility Strategy. Now I personally execute trades within about an hour or so of the email going out. Sometimes it's right away, other times if I'm preparing a livestream or answering important emails it may be an hour later, but I execute closer to the time of the email.

My official entry price was 66.16

Official VTS performance is tracked based on the live fill prices of that ThinkorSwim account you see in the livestreams. So my official entry price was 66.16 which was taken after the email went out.

BUT, towards the end of the trading day President Trump announced a pause of the Tariffs and the VXZ crashed pretty hard in the last hour. It actually closed that day at a price of 58.43, which is a very big difference.

Traders entering within an hour of the email around 66.16 vs traders who entered late in the day around 58.43. That's over a 10% difference intraday!

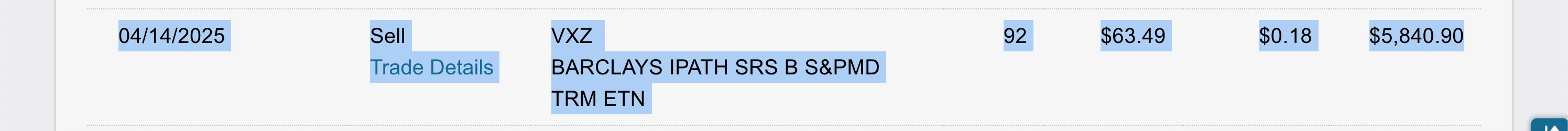

This is a chart of VXZ from the day we entered on April 9th to the day we exited on April 14th.

Highlighted green are my entry and exit

Highlighted yellow is the end of day price on April 9th

You can see my official exit price on April 14th is marked in green at 63.49

The official VTS performance on this trade will be -4.04%

Somebody trading end of day would be up 8.66%

I would imagine most people in the VTS Community is somewhere in between those two final returns, depending on what time of day you executed but this does mean that there could be a 13% difference in just a single trade.

Now obviously that was a rare occurrence and the market reaction of Trump backing off his tariffs was a special circumstance, but the point still stands

There can be large intraday differences in prices, in BOTH directions

This is why I bring up the law of large numbers. Sometimes you'll win, other times you'll lose, but over a longer time horizon it should all average out. I can illustrate another live trading example where it went the other way.

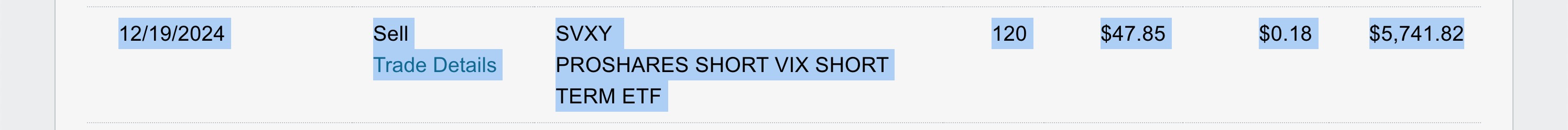

Example 2) December 19th, 2024 we exited SVXY

On that day our Tactical Volatility Strategy got the signal to exit our Short Volatility SVXY position and move into GLD Gold.

When the email was sent the official VTS portfolio exited at 47.85

SVXY crashed into the close and the official end of day price was 45.60

The difference between our official price and the end of day was 4.93%. We also have to factor in the GLD Gold price that we entered into was also different.

The end result is there was about a 7% gap there on that one day between performance depending on what time of day the person executed.

There are countless examples of this. The truth is, markets can actually move a significant amount intraday, and we are ALL subject to this intraday noise. None of us can predict what time of day will be best to execute.

Win some lose some

In this basic 2 day example I'm going through, if a person was consistent with their time of day entry and exit, they would have been on the winning end of the SVXY trade and the losing end of the VXZ trade, or vice versa. You can see how it can start to average out long-term.

Ignorance is bliss

The only reason most people aren't aware of this intraday noise is that their financial advisor or fund manager doesn't tell them when the trades are taking place, and the person isn't executing their own trades.

If you follow my trades in my portfolio, of course you will be taking every trade yourself and you will be fully aware of the pricing you get. If you're watching the market, you'll also be aware that at several times throughout the day there would have been better prices.

You'll drive yourself crazy second guessing and doubting your actions

Take your trades, ignore the noise

We just have to take the trades and trust that the law of large numbers will mean in the long-run it will all average out about 50/50 and our performance will converge to the same level.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.