How often do the VTS strategies change position on the same day?

Dec 29, 2020Hopefully everyone had a fantastic Christmas! One more party and overindulgence of food later this week for New Years, and then we're off to the races in 2021. Here's hoping for a much more normal and boring 2021.

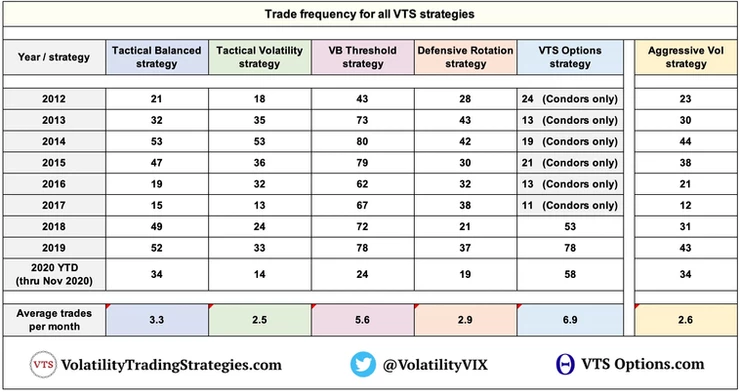

If you're ever interested in seeing how active each of our VTS strategies are, just remember that I do update the trade frequency chart down below the daily trade signals every few months. It's below the trades so you may not know it's there, but you can check it out whenever, it looks like this:

However, that shows the overall trade frequency. Today, I thought we'd take a closer look at the alignment of changing trade positions with respect to each other on the same day.

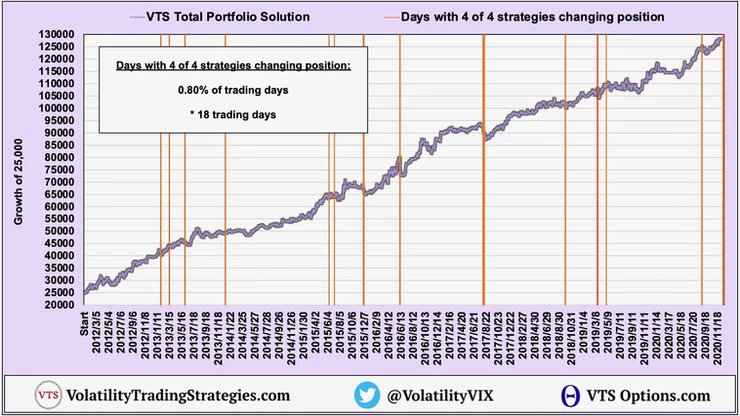

As I mentioned last week after it happened twice recently, the number of trading days where all 4 VTS strategies within the Total Portfolio Solution change position is pretty rare.

All 4 Total Portfolio Solution strategies means:

Tactical Balanced

Tactical Volatility

VB Threshold

Defensive Rotation

* VTS Options is not included in this

4 of 4 strategy trades happens on 0.80% of days:

Days when all 4 of them change positions has only happened 18 times in the last 9 years and that typically will be when the level of market volatility is already fairly close to the thresholds between trades. Last week we were in all safety positions for a few days, but very close to the threshold of moving back to aggressive positions, so it didn't take much to push them all over. We had a decent size volatility crush, so it pushed everything back to risk on.

3 of 4 strategy trades happens on 4.20% of trading days:

3 of 4 is a little more common, but still that averages out to 10.5 trading days a year which is a little less than once per month.

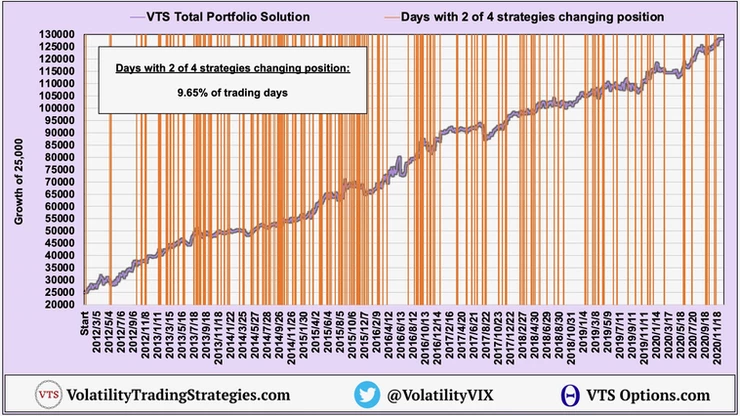

2 of 4 strategy trades happens on 9.65% of trading days:

2 of 4 is now showing 24 trading days a year, or roughly twice per month.

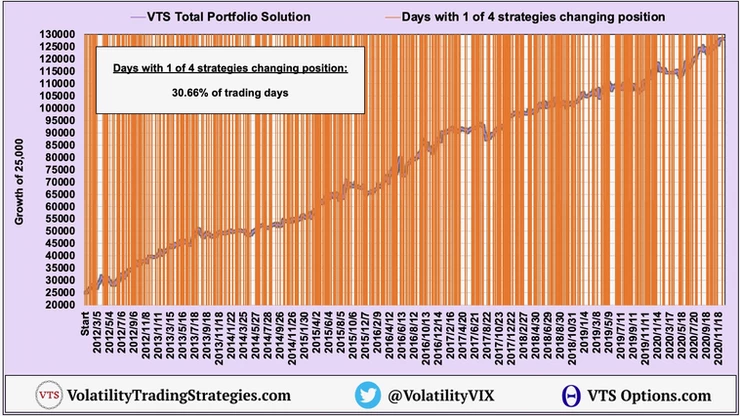

1 of 4 strategy trades happens on 30.66% of trading days:

Having 1 strategy change position in any given day is pretty normal

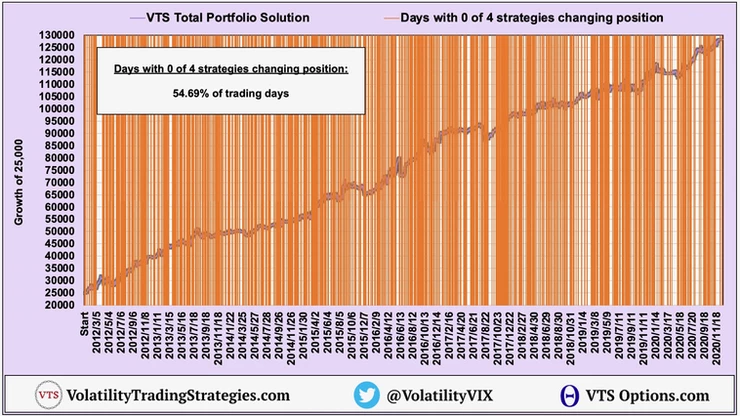

0 of 4 strategy trades happens on 54.69% of trading days:

On slightly more than half of trading days there aren't any new positions taken, we would just be maintaining the positions we held from the previous day.

The 4 main VTS strategies are what could be considered trend following. We are looking to align our daily position with the ETF and asset class that has historically performed best given that level of market volatility. The best periods of gains happen when we catch a longer term trend and just maintain positions as they gain value.

However, it's very important that we remain nimble and able to move out of any position and into something more suitable on a 1-day time frame. Remember, every 10, 20, or 50% stock market crash begins with that first day where maybe it only goes down 1-2%. Can't have a 20% drawdown without a 2% drawdown first right?

If we want to reduce drawdowns and have the smoothest investing experience possible, we have to follow the systematic nature of the strategies and exit positions at the first sign of trouble. Waiting even 2-3 extra days could be disastrous, as often times market crashes start with warning signs and then accelerate to the downside a few days later. I prefer to heed the warning signs and just move to safety, just in case.

Worst case scenario it's a temporary warning, we get whipsawed a little bit, and then just move back into the original positions, no big deal. Small whipsaws don't affect the long term results very much, but large drawdowns certainly do which is why we prioritize avoiding those.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.