VTS Defensive Rotation as a stand alone strategy?

Sep 13, 2021VTS Community,

Great question from Michael today that maybe some others in the community are wondering as well:

"Do you think the Defensive Rotation strategy is effective as a completely stand alone strategy? As in, a 100% allocation to it?"

I'm going to say no to that on general principle, but after I explain the reason why I'll circle back and offer a caveat where under certain circumstances it perhaps could be viable. The main reason I'm saying no though is that diversification really is a very important aspect of successful long term investing, and no matter how good a strategy has performed it should never be over-allocated to.

1) From a mathematical perspective, diversifying across multiple strategies can end up improving results long term. Now I'm not talking about the standard way diversification is used in the financial industry which is not effective at all. The sad truth is that most of the time financial advisors are just holding various asset classes in different allocation sizes that "sound" different, and then they claim that the portfolio is diversified.

For example, they may hold equities, bonds, real estate, precious metals, emerging markets, maybe even some hedge funds or private equity. Since they all sound different enough, the advisor says it's a diversified portfolio. However, since the mathematical correlation of many of those assets is extremely high (especially in a crisis) the portfolio ends up going down with equities anyway because most of the other assets also track equities with very high correlation.

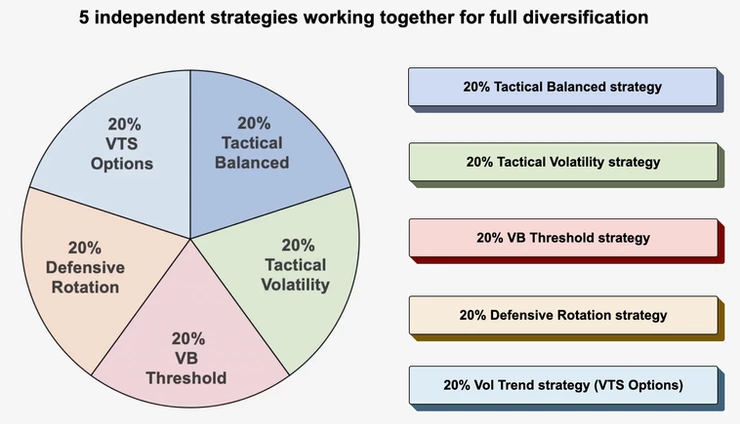

However, there are ways to add true diversification within a portfolio that is very valuable. Trading multiple lower correlated strategies along with some tactical allocations too long volatility when necessary can add mathematical diversification and improve both the absolute and relative performance.

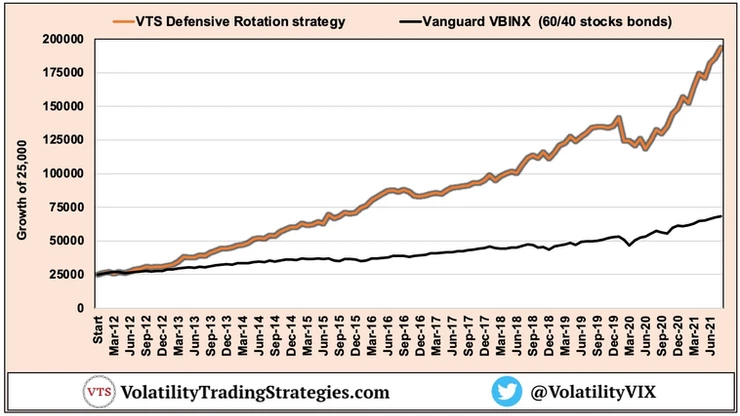

2) We don't know what the future holds. It's easy enough to see on a chart that the Defensive Rotation strategy has done extremely well, which is probably why this question today is being asked. The thought is, since the strategy has done so well, why not just put 100% of capital in it?

Defensive Rotation strategy:

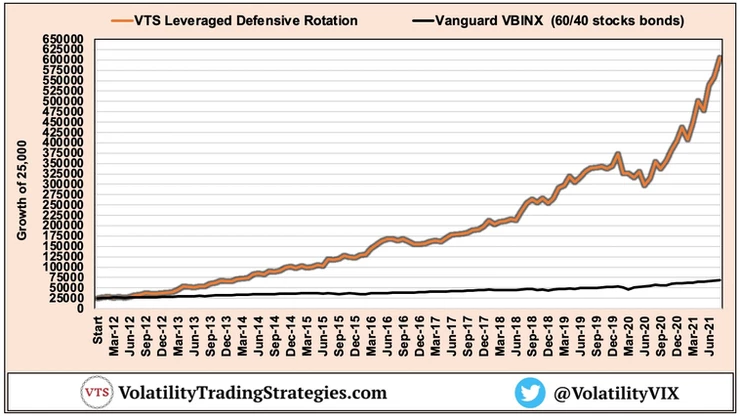

Leveraged Defensive Rotation strategy:

But we can never be sure what the future holds, or which strategies will be the best performers going forward. I've had several years where the Tactical Volatility and Aggressive Vol strategies are by far the best performers. I've also had years where the Tactical Balanced strategy has been the best one. And this may come as a surprise considering how poorly it's done in the last year, but the VB Threshold strategy has also had long stretches of fantastic results.

The rock star right now is clearly the Defensive Rotation strategy but I can't say with certainty that will be true going forward. Perhaps one of the others is just getting ready to go on a successful run, but just because one strategy stands out as the best recently doesn't mean diversification isn't still vitally important.

Small caveat where I'll be a little flexible:

A few months ago the answer to whether Defensive Rotation can act as a stand alone strategy would certainly have been no. Remember, in the past the strategy only held Utilities in high volatility environments, and while utilities have proven more resilient in market downturns than equities, they still are highly correlated to stocks and will go down when the stock market does.

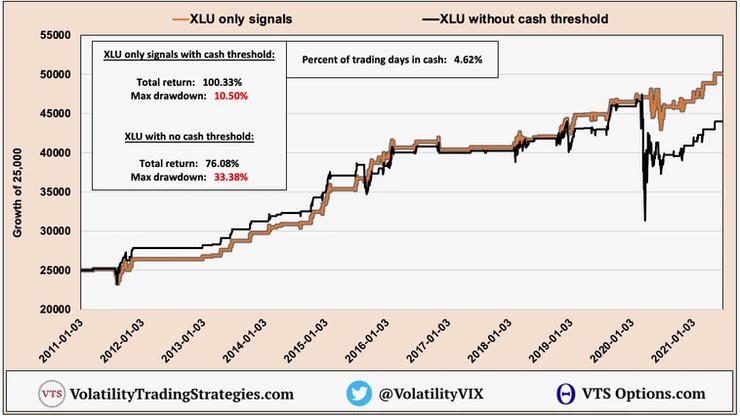

We've recently made a small adjustment to the strategy where I've added a sliver of a cash position in the most extreme volatility periods which will significantly reduce drawdowns during the worst times for the market.

Here's the XLU Utilities signals only, showing the comparison with and without the cash threshold:

As we can see the maximum drawdown can be reduced significantly by allowing the strategy to exit to cash when the markets are the most uncertain. That cash threshold won't flag often, historically it happened on less than 5% of trading days, but that little sliver of safety can make a big difference during the next extended recession whenever that might be. We always have to be ready!

Backtest of Defensive Rotation with the new Cash threshold:

* Remember backtests are only for showing generalities and not meant to be forward predictions

Conclusion:

With the recent changes to the Defensive Rotation strategy and the added cash threshold, it joins the rest of our Tactical strategies with the ability to move to safety when necessary:

Tactical Balanced rotates to Bonds and Gold in a crisis

Tactical Volatility rotates to Cash and Long Volatility in a crisis

Aggressive Vol rotates to Cash and Long Volatility in a crisis

Defensive Rotation will move to Cash in a crisis

* VB Threshold is under construction and will be re-introduced soon

All strategies are designed to avoid the worst of a crisis, and believe me, these positions will be required. I'm under no illusions to how weak this economic cycle is. I have no doubt what so ever that these safety positions will all be put to good use in the coming months and years.

I trade all of the VTS strategies in my portfolio because a) It adds mathematical diversification that does improve risk adjusted performance, and b) because markets change and each of my strategies is designed to succeed in different environments. I invite all of you to do the same:

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.