Drawdown reduction is the whole game

Mar 26, 2025

VTS Community,

At the low a few days ago the S&P 500 was down just over 10% in this latest correction. Now it's far too early to know whether it's over, things could easily deteriorate and go right back down, but in my last few videos and livestreams I've talked about the benefits of exiting to safety to avoid excessive drawdowns.

It's not always obvious to people what the point of exiting to safety is, given that the market "tends" to push towards all time highs as time goes by. Sure it has corrections and crashes along the way but it does get back to all time highs right? So why not just stay in the market all the time?

Why does buy & hold investing make such a poor rate of return?

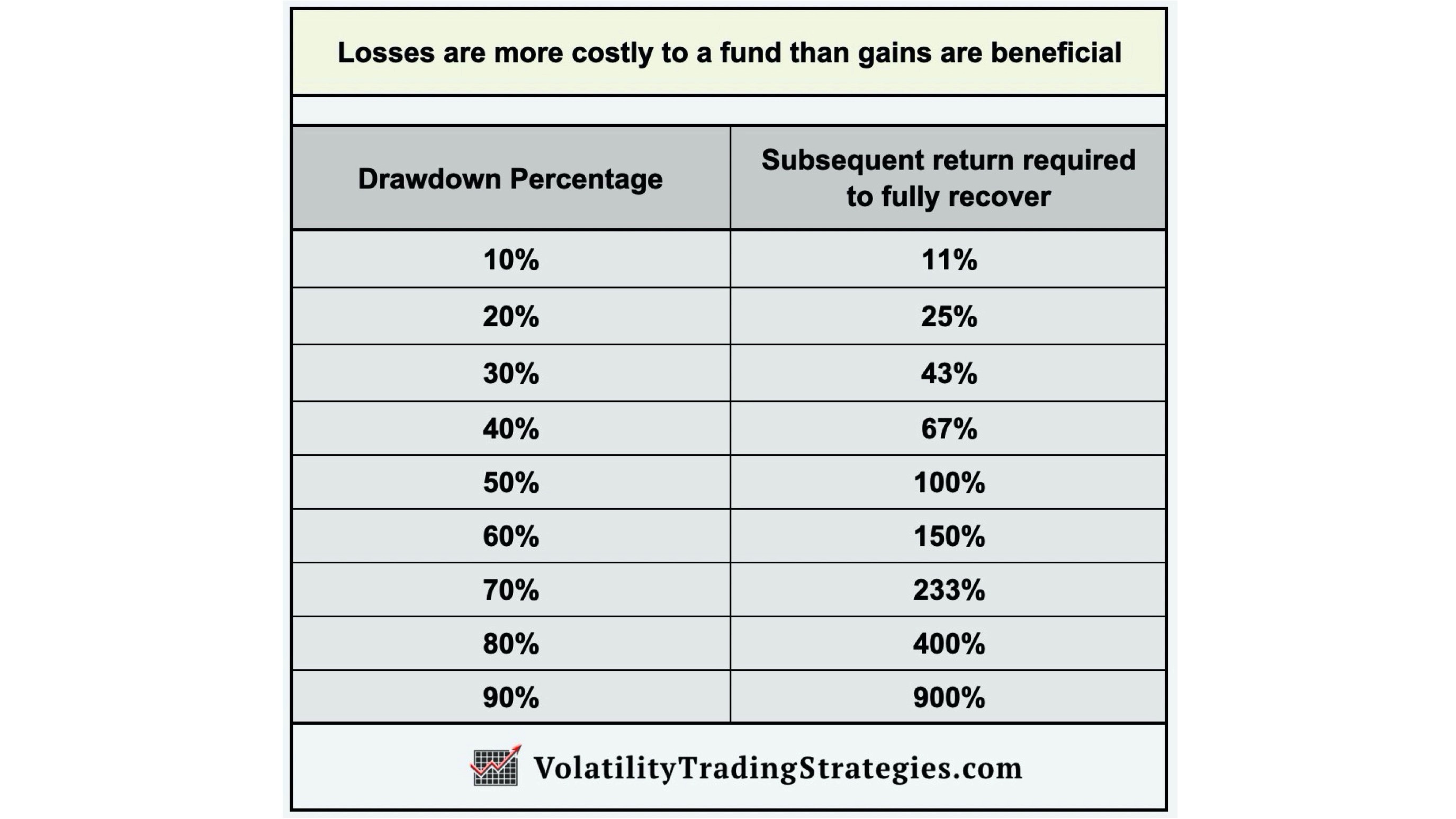

It's mainly just a math problem. The larger the drawdown, the more the market has to go up afterwards just to get back to break even. A 10 or 20% drawdown isn't the end of the world, but 30% or maybe even 56% like we saw in the financial crisis, that can take many years to recover from.

The S&P 500 has recovered a few percent in the last week and is currently down about 6.16%. That means it needs a 6.56% rate of return from here to get back to all time highs. If that happens, great, we moved back into the SPY a couple days ago so that would benefit us. Especially since we moved to safety and avoided the whole drawdown, we're starting at a much better place which is the point of tactical investing.

S&P 500 1-year chart

The 2x Nasdaq QLD that we use in our Defensive Rotation Strategy is a lot further away, and that gap between drawdown and recovery is also more pronounced as well. Remember, the larger the drawdown the more exponentially better the return after has to be to recover. Currently still down -18.25% requiring 22.32% to get back to break even. Good thing we skipped most of the drawdown being in Utilities and Cash, and now that we're back in QLD it would be great to see it return to the high.

2x Nasdaq QLD 1-year chart

The SVXY is where things get interesting. Given that the drawdown last August that took it down 39.89% was relatively large, that means it requires a subsequent return of 66.36% just to get back to break even. As I showed in this video here, we skipped a lot of that being in GLD Gold which of course is very helpful because who knows how long it will take the SVXY to get that 66.36% back.

SVXY 1-year chart

The overall point is, drawdown reduction is the whole game here. Trust me, there will be plenty of periods where the market cooperates and it seems almost easy to make a great rate of return. That's especially true since we use leveraged Nasdaq and Short Volatility. There are lots of periods where they can make huge forward progress in a short period of time when we ride a good trend.

The goal is to not get trapped in one of those excessive drawdowns that require a 50% return or more just to get back to break even.

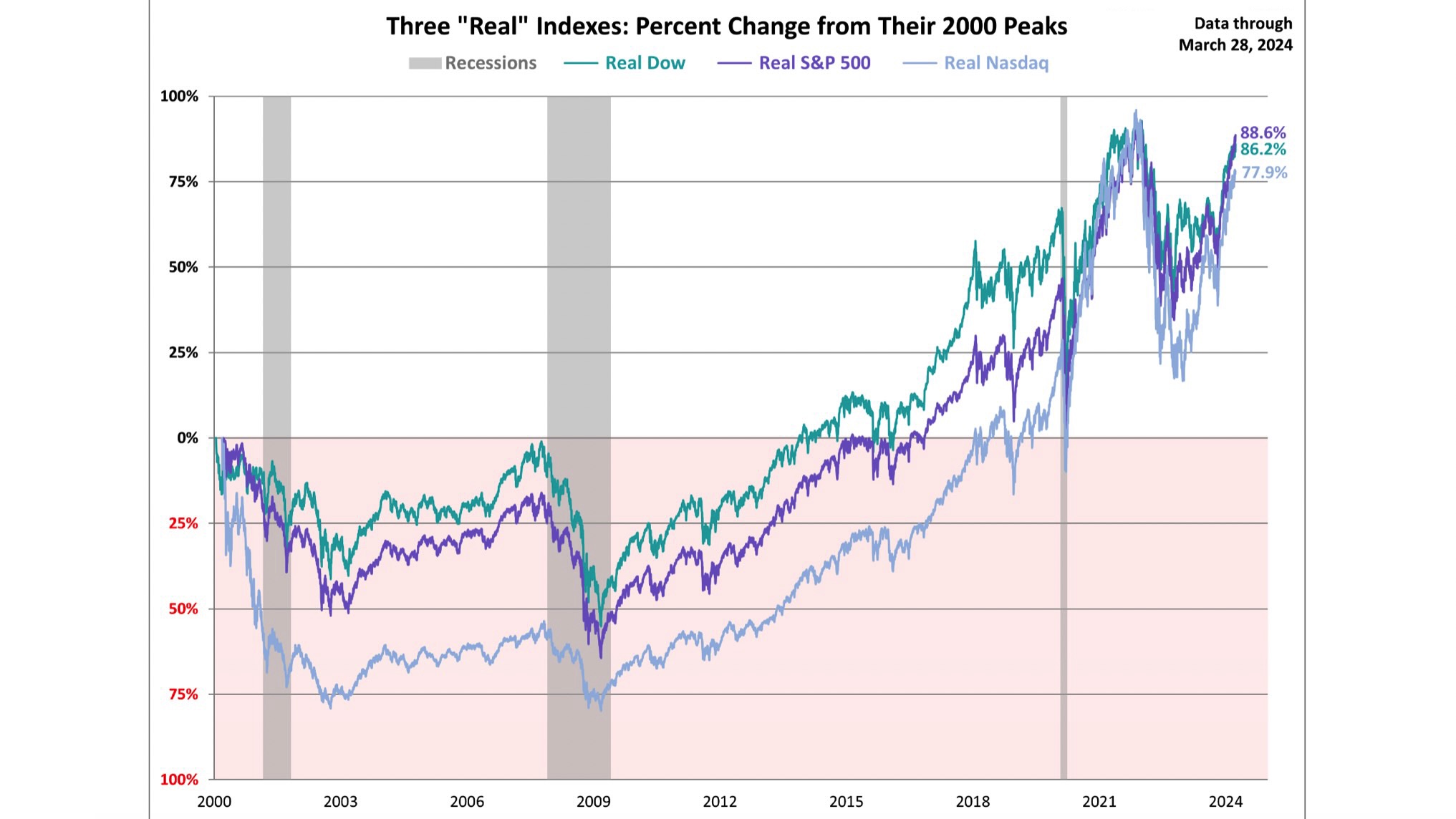

The reason the S&P 500 took so long to recover from the financial crisis was NOT because it didn't have good years after that, it actually did. The stock market bounced strongly and starting in March 2009 the performance was exceptional.

The problem was after suffering a 56% drawdown, it required a 127% after that just to get back to break even which took several years! And including the 2000 crash, we're talking 17 years for the S&P 500 just to break even.

When my Volatility metrics tell us to move to safety, I can't tell anybody what to do, but it would be my strong recommendation to take those warning signs seriously. As I always say, the point of tactical investing is to try to remain as close as possible to striking distance of all time highs within the portfolio, regardless of what the market is doing.

Reducing the drawdown in the next recession is the biggest value add for investors, and can save you YEARS of digging out of a hole.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.