Options Trade #40 - UVXY Long Vertical Put Spread (Vol Step)

Mar 25, 2019VTS Community,

What a difference a day can make. Last Thursday everything was calm, the VIX futures curve was normal, and the S&P 500 seemed like it was finally clear of that strong support area around 2820. The next obvious level seemed to be 2880. Then out of nowhere on Friday we had one of the largest volatility spikes in quite some time, and the S&P quickly finds itself back below support.

Will be very interesting to see where we go from here. One would think the outcome of the Mueller report may have been positive and put a bandaid on this downward action, but so far it has just seemed to slow it down a little.

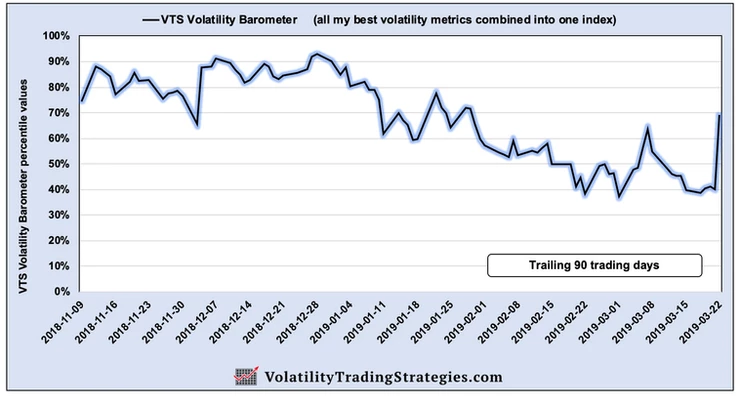

And when I say large volatility spike, I mean of the only a few times a year variety. My VTS Volatility Barometer went from 40% to 70% in a few hours last Friday. A very strong move.

Since the only ETF based positions that make sense right here from a risk reward perspective are safety positions, what I typically do is look for options trades for any of my exposure.

- Iron Condors make sense right now with the increase in volatility lately. - Bull put spreads as well if anyone wants to try knife catching and betting on a recovery. - Wheel of Fun targets shouldn't be too hard to find either as a few names have been beaten down.

But I'm going to go for something with a little more volatility exposure today, a Vol Step Strategy trade on UVXY. I've leave a link to the Vol Step Strategy video that explains why these trades are so effective, and how to set them up down below.

Today though, instead of explaining the basics, I'd like to share with you one of several ways that is effective in determining when to open them. Now I have several trigger points and market metrics that I'm looking for so this is just one of several potential entry metrics, but in keeping with my policy of sharing as much proprietary information as I can to help you develop your own skills, here's one way to do it.

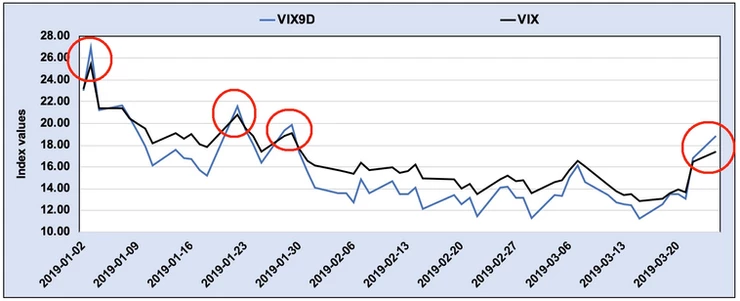

- The VIX index measures 30-day forward implied volatility. - The VIX9D index is much the same, just a shorter 9-day view.

So very similar to a simple vs exponential moving average, when you have two indexes like the VIX and VIX9D, those crossover points can signal when short term volatility is rising faster than longer term volatility. Those inflection points where VIX9D accelerates faster than VIX and moves above it shows volatility is rising quickly and can be used as potential entries for this type of trade.

Now I want to make clear, that means it's more of the contrarian style trade, looking for volatility to settle back down. There are of course times when volatility rises and keeps going, so that's why I always keep these types of trades to a very small allocation of capital.

VIX9D : VIX for 2019 so far:

The Trade:

Long Vertical Put Spread on UVXY for May expiration

BUY to OPEN 2 x 17 May 19' UVXY 45 PUT SELL to OPEN 2 x 17 May 19' UVXY 40 PUT Debit: ~ 2.80

* prices change throughout the day so the lower the price the better

Margin Requirement:

Long vertical spreads are defined risk trades and require very little margin. It's just the cost of the contract multiplied by the options factor of 100, and then multiplied by the number of contracts.

2.80 x 100 = 280.00 margin per contract 2 contracts x 280.00 = 560.00 total margin required

560.00 / 25,087.37 model portfolio value = 2.23%

* You can scale your trade to roughly 2-3% of available capital within your VTS Discretionary allocated funds.

Risk management / future action:

Often times if I capture most of the profit I close them out early to reduce gamma risk, but since these are very small allocation trades I need to factor trade fees in the equation as well. That does mean sometimes I just let them expire. If you want to keep things really simple you can also consider them "set and forget" trades where you just let them expire each time. Just make sure to check the trade once per day in case you get one of those very rare assignments on the contract.

The Vol Step Strategy is a major tool in my options trading toolbox, one of several of my go-to strategies. Remember the most important aspect of successful long-term investing is managing emotions and sticking to the process and trading plan. However, learning the fundamentals of each trade is important as well so please check out the full explanation video here, and as always feel free to ask me any follow up questions.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.