Read this before considering adding leverage to VTS strategies

Apr 21, 2020Due to the sheer number of questions I get regarding adding leverage to the VTS strategies, I will (reluctantly) add leveraged sub-pages to the website for each of the current active strategies. I'll give potential ETFs people can consider using, and show the charts and statistics for how that strategy would have performed in the past using the leveraged alternatives. Over the next couple weeks those will be added to the website and updated regularly going forward.

Before I do that though, I'd like you to read through my thoughts and warnings today about adding leverage in your trading. The short answer is you don't need to add leverage to make a great long-term rate of return. The long answer and the #1 biggest question you need to ask yourself is:

WHY are you considering adding leverage?

Before we even get into any details at all about what rate of return can be achieved, you need to be brutally honest with yourself about your motivations for wanting more leverage.

Full disclosure: I have never used leverage in any of my strategies at any time in the past 15 years. Beyond that, not only do I not use any leverage, but I usually have a healthy portion of cash positions as well so I'm rarely even fully allocated.

While I can't say for sure I wouldn't use leverage going forward (I don't know the future) I can say with certainty I've never done so in the past. So I stress, I am NOT planning on using any of the leveraged alternatives. When they hit the website, they won't be direct links, they will be slightly hidden, and I will not be using them. I'll continue with the main strategies as I always have.

Again, WHY are you considering adding leverage?

- Are you trying to play catch up because you started investing later in life and feel like you need to accelerate things?

- Have you taken some losses recently and you're trying to make up for them by taking on additional risk to get it back?

- Do you have unrealistic pipe dreams about being a full time trader and feel like a bigger rate of return can get you there?

* I'm sorry but yes I did say full time trading for a living is a pipe dream :) I've got 2 videos now warning against full time trading you can check out here and here.

You really need to be honest with yourself and get to the root of your motivations for being ok taking on more risk. You may think that it'll just mean a larger rate of return, but there is a flip side to that coin. It also means larger losses. Remember, mathematically speaking losses are more costly to a fund than gains are beneficial. The larger the drawdowns you introduce to your investing, you need an exponentially larger subsequent rate of return to get back to break even.

- If an un-leveraged strategy suffers a 20% drawdown, it won't be any fun at all but it isn't the end of the world. It'll take a subsequent 25% rate of return to get back to break even.

- But if a 3x leveraged strategy suffers a 60% drawdown, now you've dug a deep hole that might take a long time to get out of. After a 60% drawdown the investor now needs to make 150% subsequent return just to break even.

Make sure you know the math is stacked against you when you start taking on excessive risk. It's not symmetric on both sides, it's highly asymmetric, and losses hurt a lot more than the gains help.

I've mentioned this next point in a dozen articles and videos now, but the 3 keys to long term retirement success are:

1) Income. You need to focus on building a stable income so all the bills are paid and you don't ever have to withdraw any money from your investment account. There are few things more devastating to long-term growth than negative compounding so step one is taking care of the income in the equation.

2) Savings. Get your household budget under control and learn to live below your means so you can consistently save money and make regular additions to your investment account. Investing on a lump sum of money is fine, better than nothing, but regular additions will help supercharge your growth.

3) Investing. I intentionally put this last because without the first two, does investing even matter? If there's no income and no savings, rate of return isn't that helpful. But, if you have both of the first two taken care of, at that point consistent successful long-term investing can make all the difference in the world.

If you have a stable income and you live below your means so you can save money every month, from there all you need is a consistent rate of return and you will be very happy with where you end up.

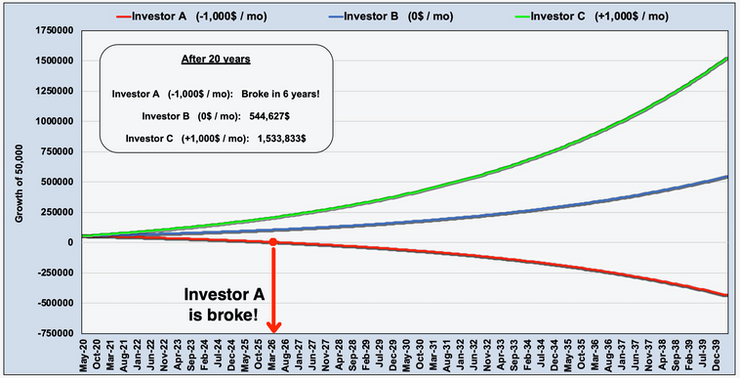

3 investor example)

Assumptions:

- 50,000 start value

- 1% a month rate of return

Within tax sheltered account

- Investor A: Withdraws 1,000$ a month to pay some bills

- Investor B: Does not need to withdraw any funds

- Investor C: Adds 1,000$ a month from savings

Conclusion:

As I said, if you're one of the many people that's been asking me to provide data for leveraged alternatives to the VTS strategies, I will do that soon. It will be a side link on the website, nothing too visible, and it'll come with many warnings and caveats.

But I will do that, just do me a favour. Please carefully examine why you're asking this question. Are you sure it's not an irrational response to a situation you've gotten yourself into? Are you sure it's not because you haven't taken care of the income and savings elements of long term success? Are you sure you're not trying to fulfill a desire to be a full time trader even though the math doesn't support that path?

Having said that, if you've carefully considered the pros and cons and you know what you're doing then fine, I would never tell anybody what they can and can't do with their money.

All I can ever do is tell you openly and honestly what I do. I work my butt off and have a good income. I live as a financial minimalist and save a lot of money every month. And I make a great rate of return with very low drawdowns along the way. I'm going to easily hit all my long term investing goals without leverage, and I hope you can follow my lead and do the same :)

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.