VTS Iron Condor Strategy changes for 2023

Jun 28, 2023

VTS Community,

VTS Iron Condor Strategy changes for 2023

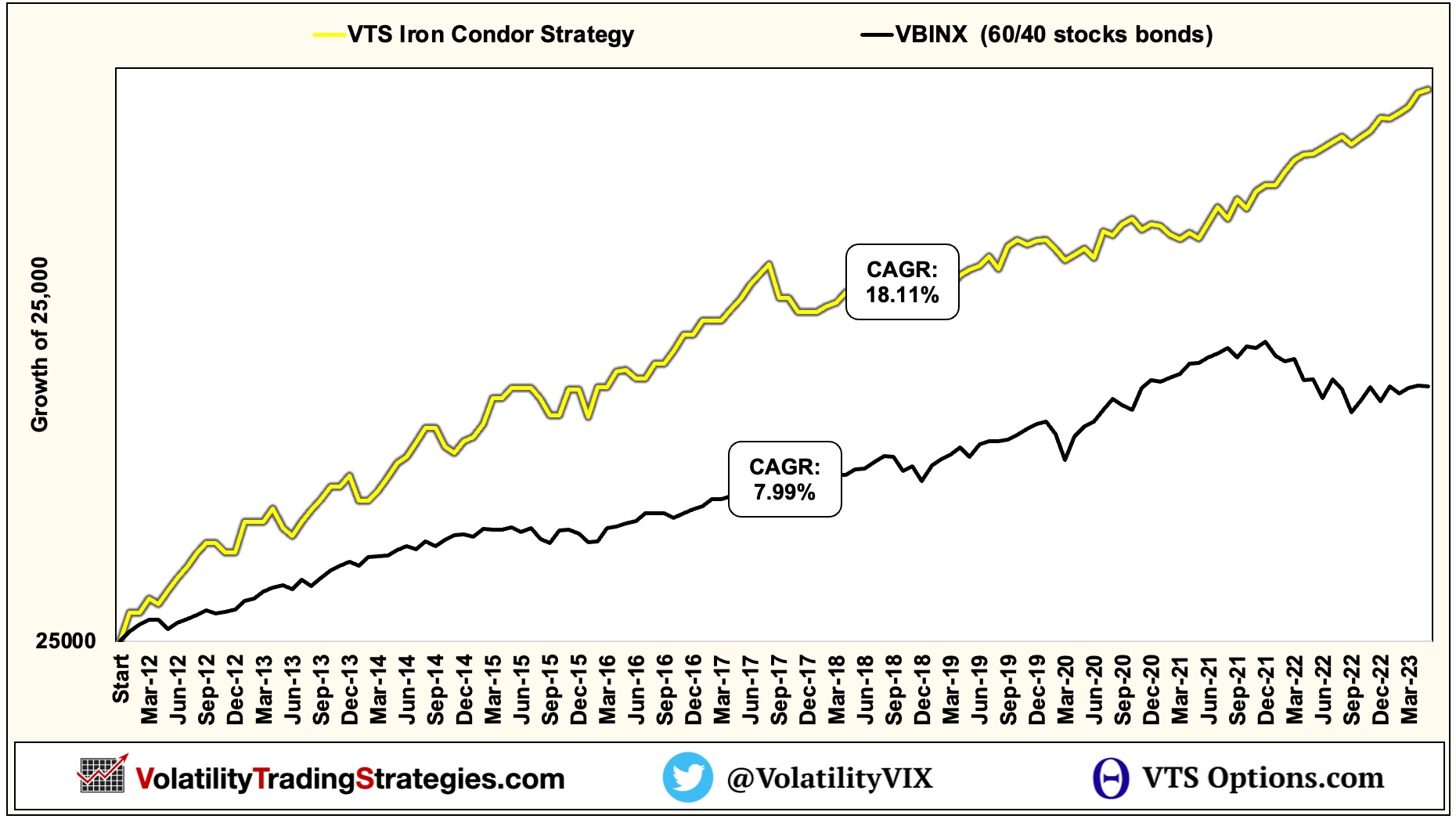

Today we dive into some analysis of the third of our five strategies that currently make up the Total Portfolio Solution. I'll highlight the two main reasons why this strategy is a staple in our portfolio and quite frankly, because it's crushing it for 11 years now it will not be undergoing any changes at all.

It's no secret that Iron Condor Options are one of my favourite. Obviously for anybody in the VTS Community, I would encourage you to make your way through the 30 video Iron Condor course that's available to you.

I give all the entry and exit details for every live trade in the portfolio of course, but it's such a useful strategy that I felt compelled to try to educate everyone on exactly why it works and how you can use it yourself. In the course I cover in detail all of the most common questions I get when it comes to navigating a successful Iron Condor strategy. Take some time, get through those videos, and ask me any questions you have.

* If you're not a member of the VTS community yet, no problem. There's a free 2 week trial available to everybody. When you sign up you'll gain immediate access to our entire portfolio, the live trades, the volatility dashboard, AND the full 30 video Iron Condor course. If you want to learn this awesome strategy, consider taking the free trial:

Click here to Claim Your FREE Trial to VTS

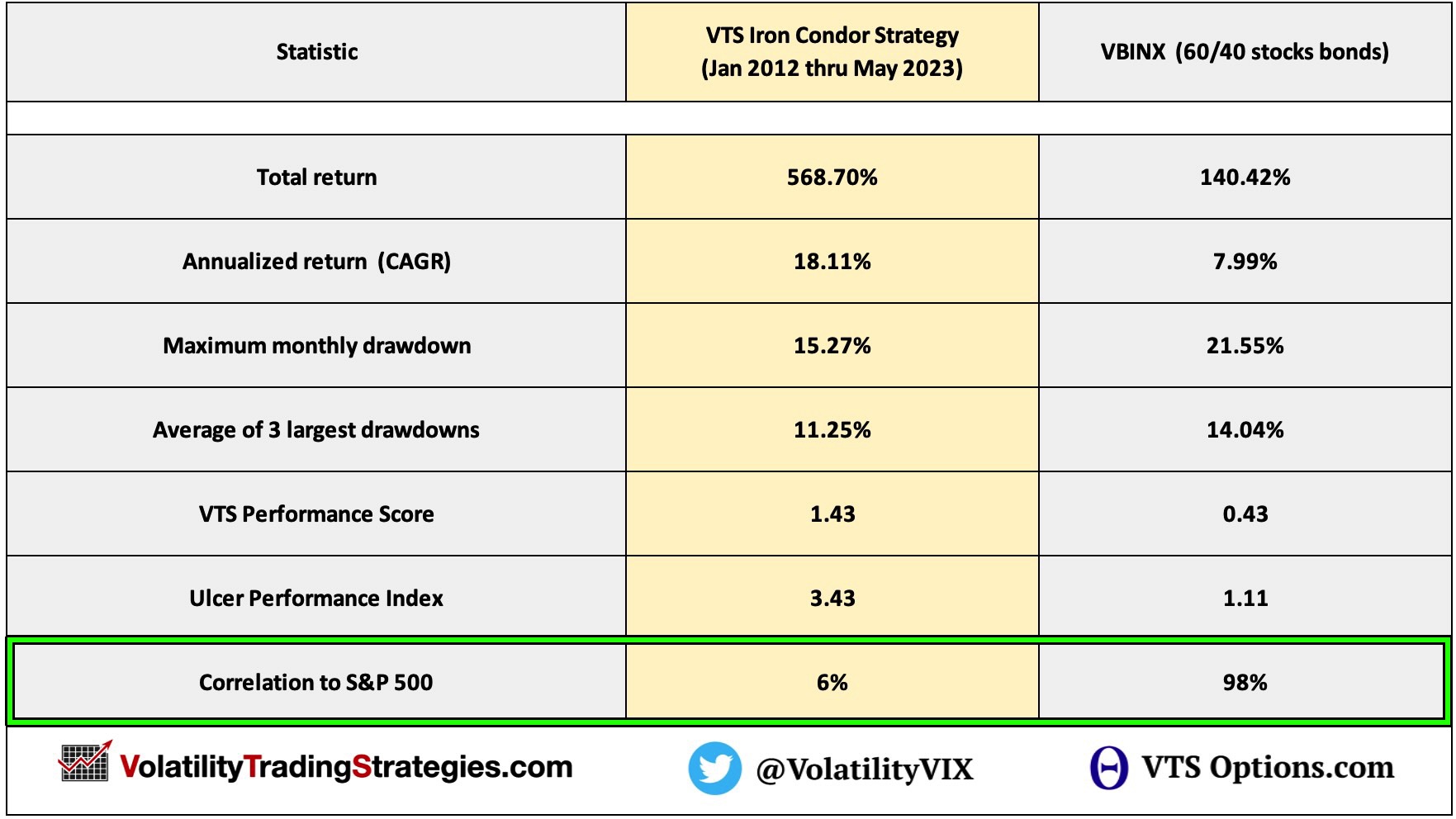

1) No correlation to the S&P 500 or our overall portfolio

As the old saying goes "everybody is a genius in a bull market"

It's not overly difficult to create strategies that will perform well as long as the S&P 500 is stable and rising. In fact, I would say the vast majority of the investing world has nothing but strategies that only do well when the stock market does. The real holy grail of investing though is having a diversified portfolio that doesn't get crushed when the market tanks and this is why the Iron Condor Strategy has a 20% allocation for us.

Correlation is ranked on a spectrum from 100% to -100% (or 1 to -1) and the vast majority of asset classes are strongly positively correlated to the stock market. Typically it's in the range of 75% or higher, and in many cases it can be well over 90%.

That's not the case for us though:

VTS Iron Condor Strategy : S&P 500 Correlation = 6%

VTS Iron Condor Strategy : VTS Total Portfolio Solution Correlation = 8%

The chances are very good that if you find something with a low or even negative correlation to the stock market, the long-term performance is likely quite poor. That's not the case with our Iron Condors.

An 18% annual return with essentially no correlation to equities and no correlation to the rest of our portfolio either, this is very rare and extremely beneficial to our long-term progress.

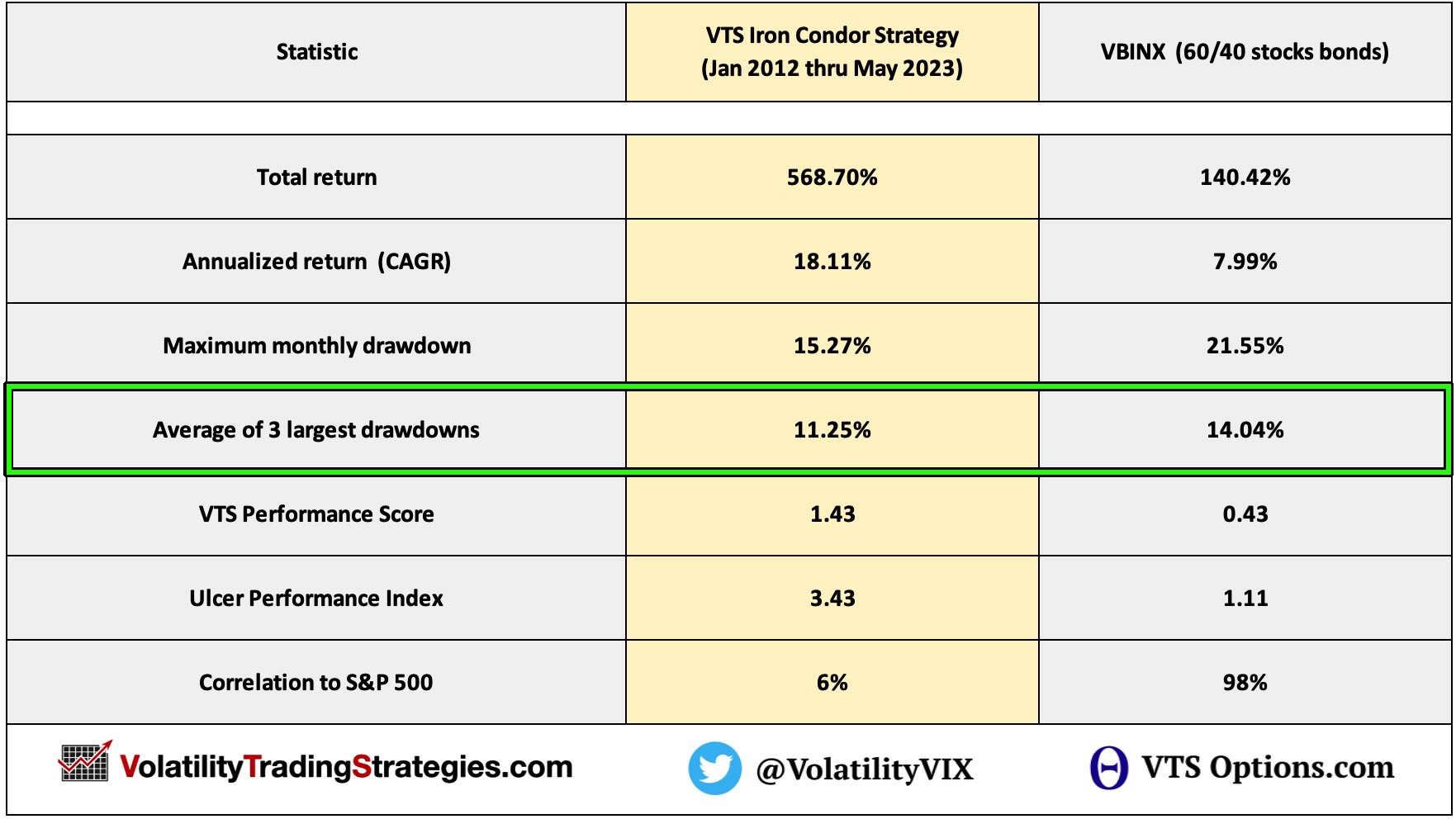

2) Excellent risk management and drawdown reduction

There are many risk adjusted return metrics that go beyond the headline performance number and can help investors determine the true risk they are taking on. Things like the Sharpe Ratio, Ulcer Performance Index, Sortino Ratio, Treynor Ratio, R-Squared, Jenson's Alpha, I could go on...

To me though, one of the most important metrics is the maximum drawdown. More specifically, the average of the 3 largest drawdowns during the entire history of the strategy.

You can't really "feel" a Sharpe Ratio. Standard deviation of return matters, but again it doesn't directly translate into an emotion. Maximum drawdown however is a direct pain point that investors will feel in real time. The larger it is, the more likely they are to pull the plug and abandon the strategy.

The fact that the maximum drawdown for our Iron Condor Strategy was only 15.27%, and the average of the three largest is only 11.25%, means there was never a time when an investor would start to feel that visceral pain and look for the exit door. 15% is probably within nearly every investors risk tolerance and that's of vital importance.

If there's a strategy that returned 30% per year but has a 60% drawdown, then it no longer matters does it? The vast majority of investors can't sustain a 60% drawdown and stay the course. They would have long since pulled the plug, so the long-term terminal results don't mean anything.

Our Iron Condor Strategy will undergo no changes in 2023

With an 18% annual return it has a proven track record of success since we launched VTS in January 2012. Far more importantly though, it has achieved that with no correlation to the S&P 500, and never breaching an investors risk tolerance of drawdowns. With a 20% allocation it certainly adds mathematical diversification to the broad portfolio.

If it ain't broke, don't fix it...

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.