VTS Iron Condor Strategy Performance Analysis

Feb 16, 2023

VTS Community,

The VTS Iron Condor Strategy was officially added to the VTS Total Portfolio Solution in January 2012, meaning with the end of 2022 now in the books, this is the 11th anniversary of our flagship market neutral strategy. It continues to play a vital role in our portfolio, with a current allocation of 20%

The reason the Iron Condor Strategy is so important in the overall portfolio is that it targets a different market environment than some of our other strategies. Defensive Rotation, Strategic Tail Risk, and Tactical Balanced are all what could be considered "barbell trend following" strategies.

- Trend following in the sense that they profit from medium term trends in the market

- Barbell meaning they can capitalize on both sides of the market, uptrends and downtrends. They have allocations to leveraged equities for good times, and safety or long volatility in downtrends and crashes.

Iron Condors however play the middle ground in the market and perform much better during choppy ambiguous times when there is no clear trend. They are market neutral and thrive in those types of environments. Look no further than 2022 for a great example of that.

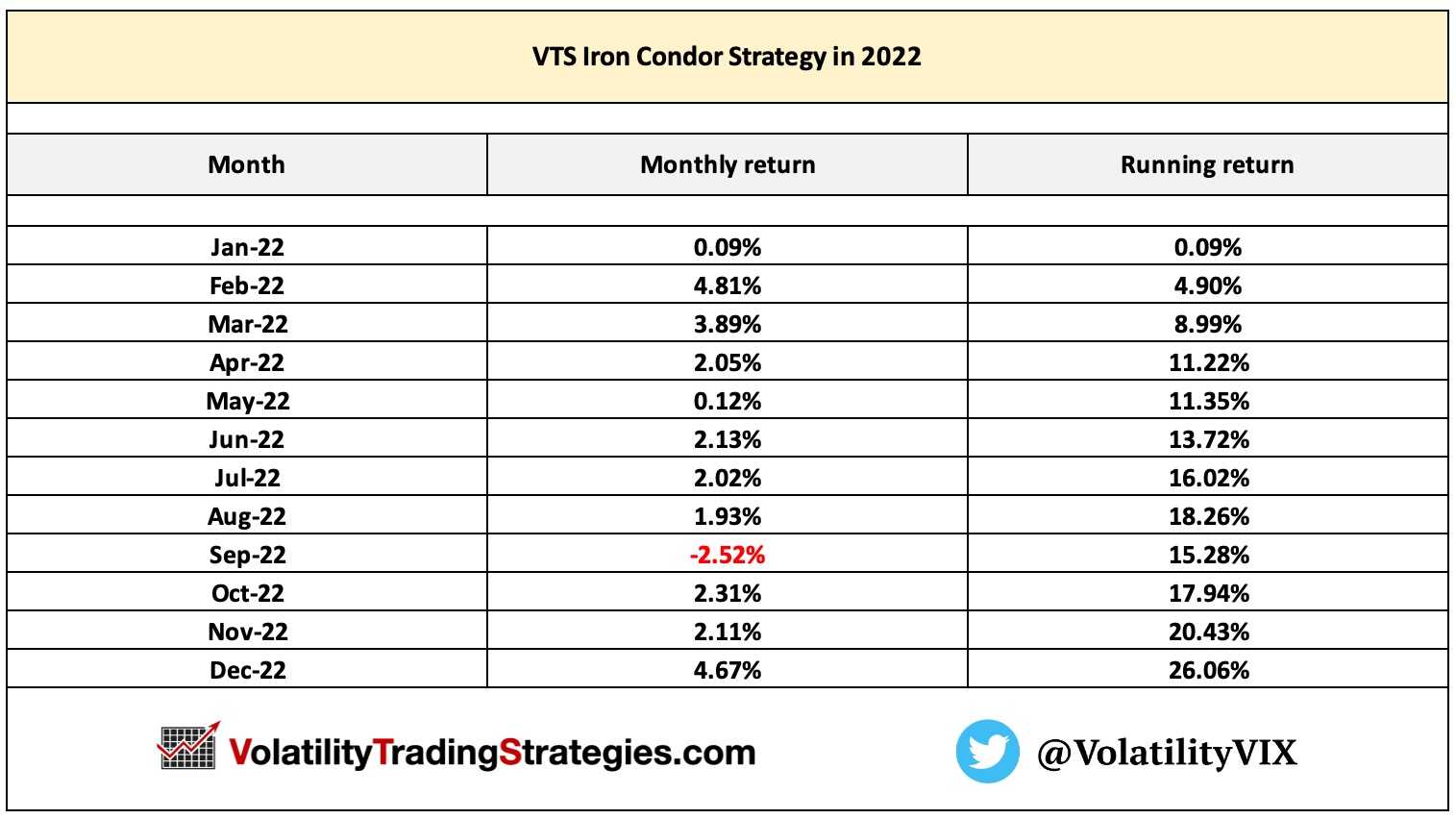

VTS Iron Condor Strategy in 2022 (+26% return)

In a year like 2022 when the S&P 500 (SPY) was down -19%, the 20 year US Treasury (TLT) was down -31%, and assets like Real Estate, Utilities, Emerging Markets etc were all down as well, there were very few places to find a decent return. Our trend following strategies also suffered in that environment, but Iron Condors did not.

Our market neutral Iron Condor strategy had a great year as you can see in the table below, ending 2022 with a 26% return.

* Watch this video later: 2022 was the Worst Investing Year Ever

VTS Iron Condor Strategy - Long-term performance analysis

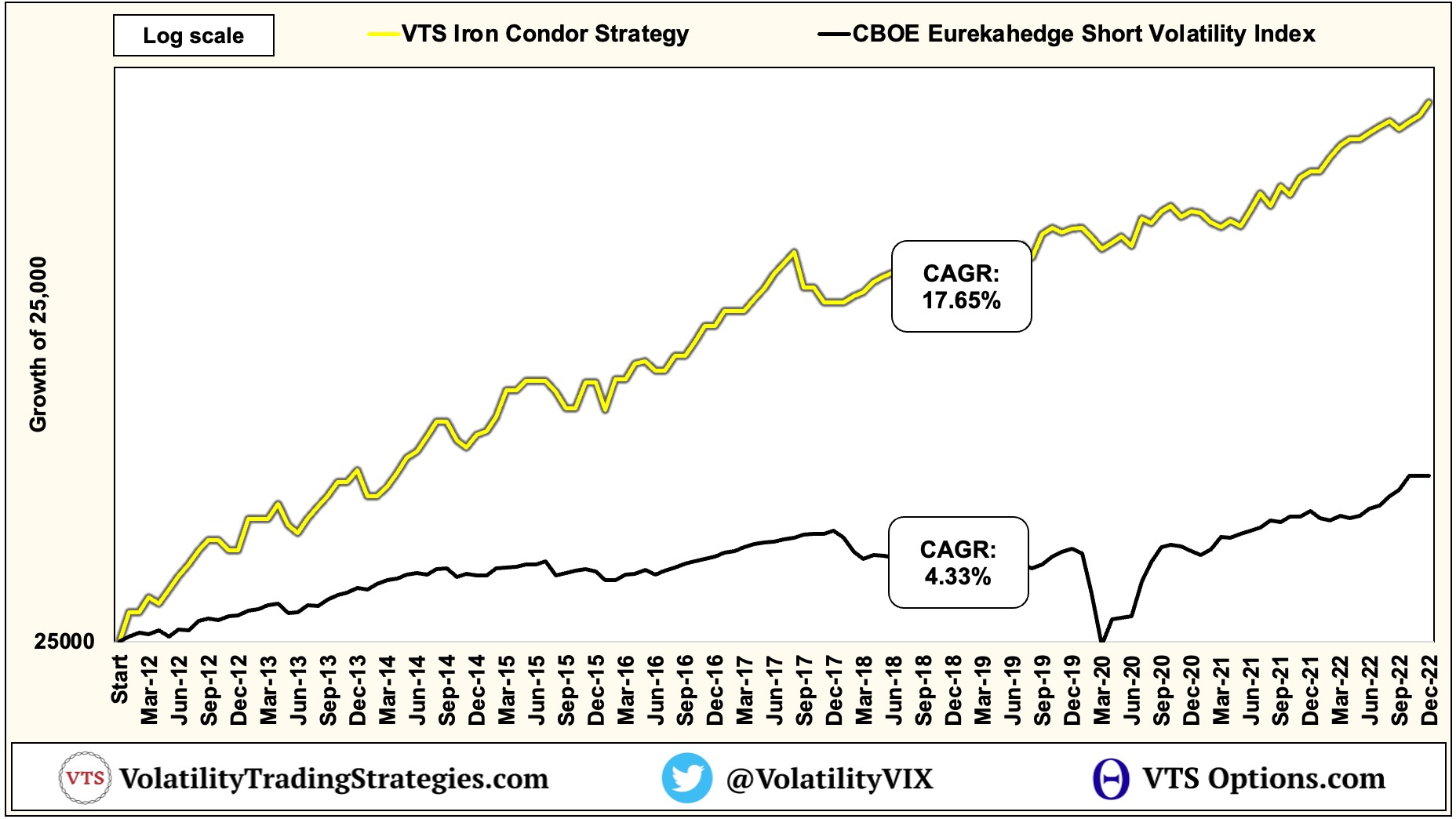

Iron Condors aren't just a choppy market period strategy. The way we trade them at VTS, layering multiple smaller trades at once, utilizing stop-losses to cycle in and out of trades faster, and adding Calendar Options which perform better in lower volatility years, I've largely remained consistent through all environments for 11 years now.

Iron Condor Strategy - Rate of return

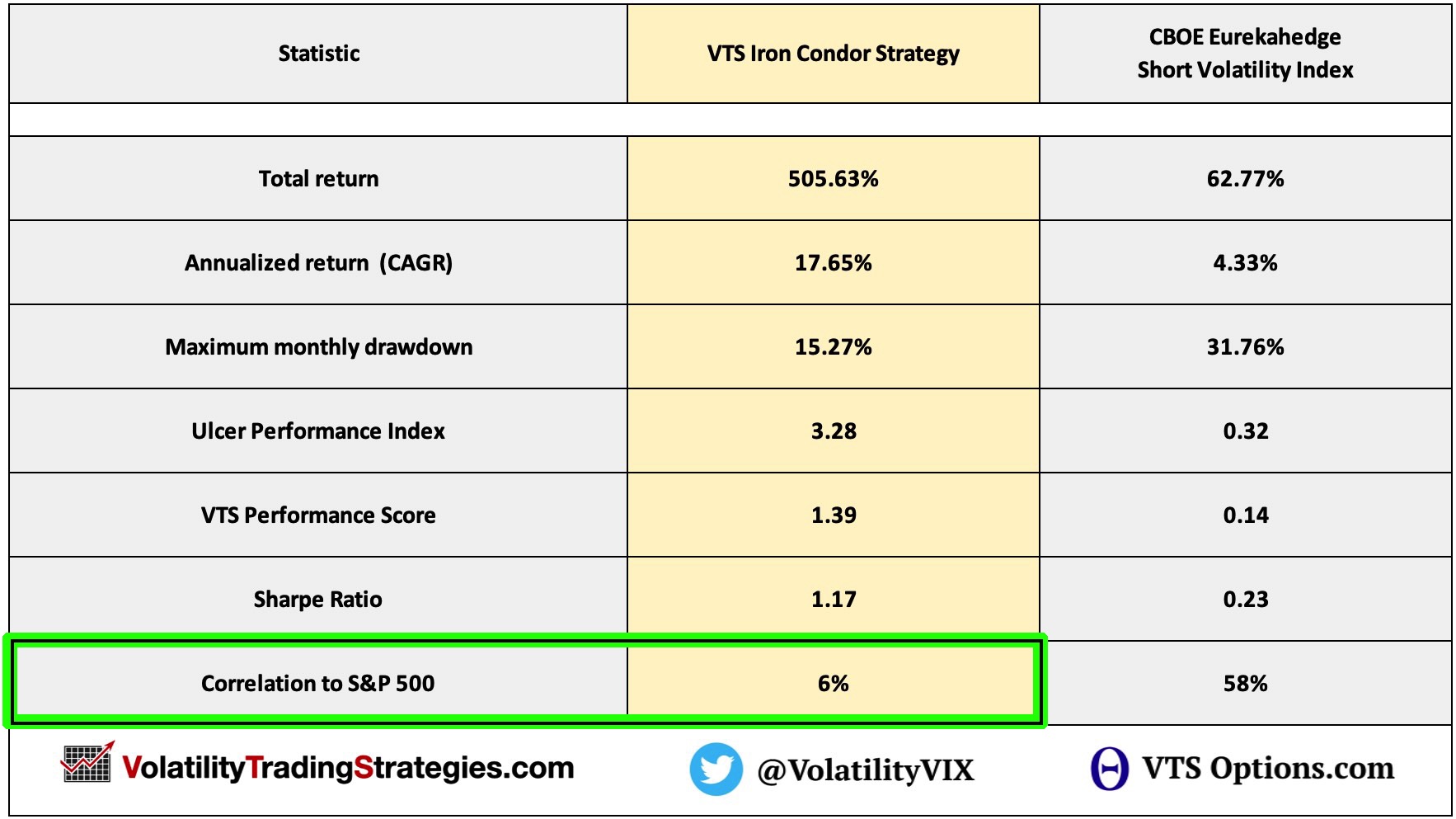

While the long-term rate of return of the VTS Iron Condor Strategy is lower than our three Tactical Rotation Strategies, that's not actually it's main purpose. Its primary goal is diversification and reducing correlation to the S&P 500 which it does very well.

Having said that, an 11 year CAGR of 17.65% is still great and definitely adds a lot of value to our overall portfolio. Even if it returned just half that much it would still be a fantastic compliment to the rest of the strategies.

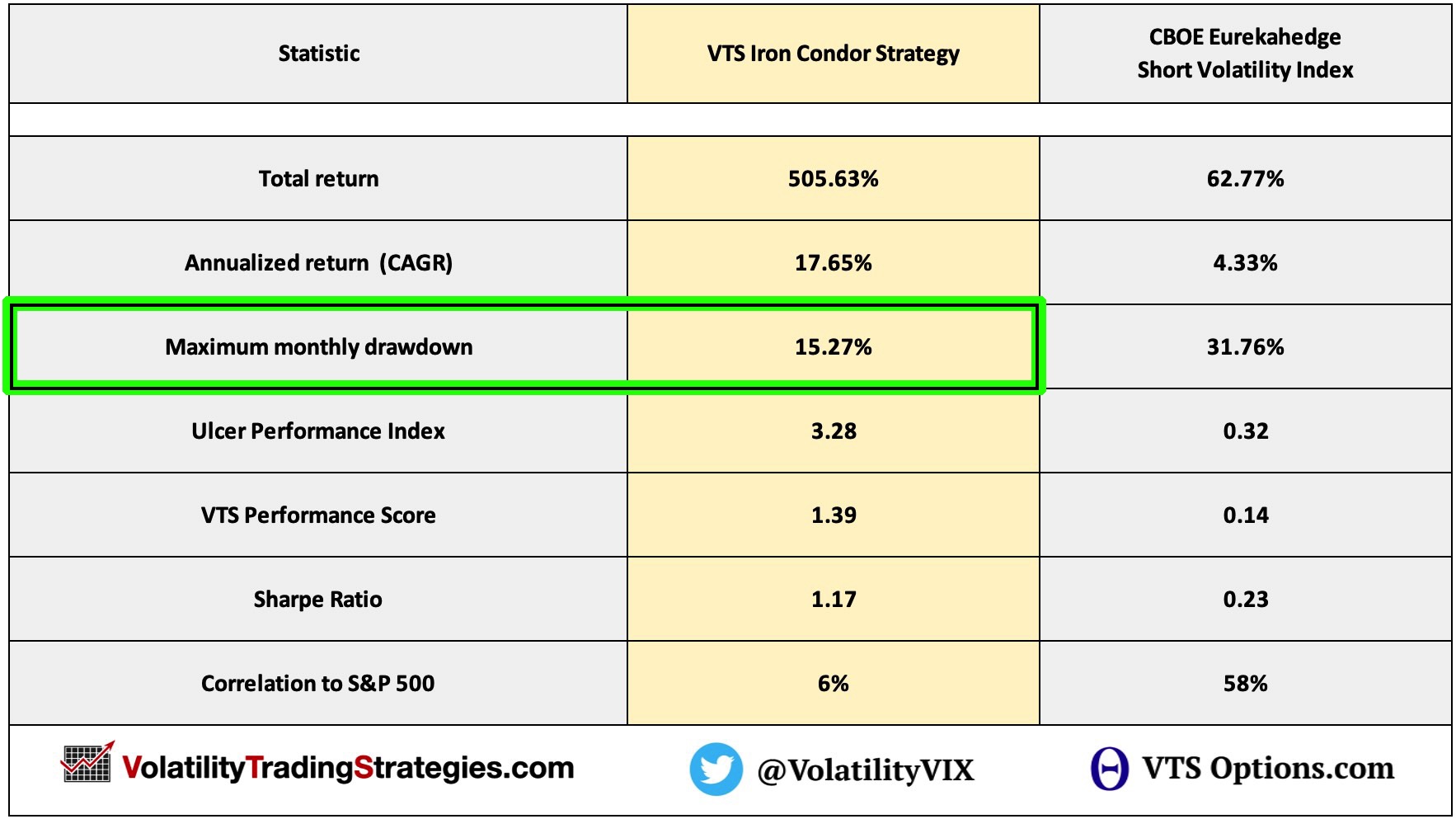

Iron Condor Strategy - Maximum Drawdown

I've been managing VTS now for over 11 years and in that time I've spoken to thousands of investors. Among all the issues investors have, I would say the one that comes up the most is the vast majority of people wildly OVERESTIMATE their risk tolerance. The financial industry is all about flashing numbers and charts to people in hopes they will invest with them for the long run.

The problem though is that investing is an emotional process, and there's nothing that interrupts that long-term mindset more than a steep drawdown. Many investors who thought they could "stay the course" and just hang on for the ride find out in a crisis they actually could not. They pull the plug and abandon the strategy, which typically sets them back multiple years.

Our Iron Condor strategy has only suffered one significant drawdown in 2017, and it was short lived. Down 15.27% in a strategy that returns even more than that on average every year is still manageable for the vast majority of investors.

That's the goal of all our strategies and the overall portfolio. While the occasional bad period is unavoidable, we have to make sure they aren't to the pain point where we abandon the long term process.

Iron Condor Strategy - VTS Performance Score

Invest long enough, you'll have bad periods where nothing is working. Anybody who doesn't acknowledge that simply hasn't been in the game long enough. Since it happens to the best of us, the real question is, did it get bad enough to leave?

Risk adjusted return metrics are an attempt to measure performance in terms of the risk required to achieve it. The most common risk adjusted return metric by far is the Sharpe Ratio. Another one that's more rare to see but in my opinion far superior is called the Ulcer Performance Index. You can see both of those in the above chart.

Personally though, I feel like the best risk adjusted return metric is the VTS Performance Score. I know, you've never heard of it. That's because I created it myself. My VTS Performance Score gets to the heart of every investors biggest pain point, drawdowns.

VTS Performance Score = (CAGR - Risk Free Rate) / Average of 3 largest drawdowns

* VTS Performance Score video explanation

You can see in the above formula, we're dividing our long term alpha above a risk free rate, by an average of all the biggest drawdowns. The goal here is to have the rate of return be as high as possible in relation to all the worst periods for a strategy. Anything over 1 is fantastic because it represents a strategy that returns more than the worse of the drawdown periods. A VTS Performance Score above 1 should mean that every investor easily has the risk tolerance to maintain course when things aren't going well.

Iron Condor Strategy - Correlation to the S&P 500

The VTS Iron Condor Strategy has great performance metrics across the board. Good rate of return, relatively low drawdowns, and fantastic risk adjusted return. However, the performance statistic I'm most proud of is the extremely low correlation to the S&P 500 at just 6%

As they say, everybody is a genius in a bull market

Strategies that do well when the stock market is smooth sailing are a dime a dozen. The question is, can you still perform well when the stock market isn't going up? There is sparingly few strategies that can do that, and I'm very proud of the fact that the VTS Iron Condor Strategy not only outperforms the absolute return of the S&P 500 by a lot, but it does so with almost no correlation.

This is yet another reason why it's such a great addition to the VTS Total Portfolio Solution.

Access the VTS Iron Condor Strategy Course

Members of the VTS Community gain access to an extended course teaching you everything you need to know about Iron Condors.

Claim your FREE Trial to VTS here and you can access it

I'm constantly expanding the course with new videos, and there's still plenty more to go. Here's the current course curriculum

1.1 - Introduction

1.2 - Iron Condor fundamentals

1.3 - Spreadsheet download

1.4 - Spreadsheet explanation

1.5 - Rules of engagement

1.6 - Iron Condor trade instructions

1.7 - Ideal allocation size

1.8 - The 30 second rule

1.9 - Stop-losses and stop-gains

1.10 - Why do stop-losses look uneven?

1.11 - S&P 500 historical analysis

1.12 - Iron Condors are best in high volatility

1.13 - Low median high volatility ranges

1.14 - Why longer dated contracts are better

1.15 - Why wider wing Iron Condors are better

1.16 - Trading on ETFs vs Indexes

1.17 - Calendar Option Fundamentals

1.18 - Calendars use different stops

1.19 - Calendar Option allocation size

1.20 - Iron Condors & Calendars in the same strategy

1.21 - Diversification into many asset classes

1.22 - All asset class data analysis

1.23 - VTS Iron Condor Strategy performance analysis

1.24 - Iron Condor trade example

1.25 - Calendar trade example

1.26 - Iron Condor / Calendar example head to head

1.27 - Ramping up the Iron Condor strategy

Conclusion

Most investors have a portfolio that performs just fine during bull markets. The problem is, the market doesn't always cooperate and there will definitely be trouble periods ahead, it's part of the investing process. I personally feel that every investor needs an allocation to a market neutral strategy to fill in some of the weaknesses of the traditional net long equity exposure.

With a great rate of return, relatively low drawdown, very high risk adjusted return, and almost no correlation to the S&P 500, the VTS Iron Condor Strategy is the perfect investing solution for anyone looking for added diversification. It's been going strong for 11 years now, and I expect that to continue for the next 11 years as well.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.