Part 3 - Tactical Balanced strategy through the 2020 pandemic

Oct 27, 2021VTS Community,

How did VTS Strategies really do during the 2020 pandemic?

Part 2: Defensive Rotation strategy

Part 3: Tactical Balanced strategy

Part 4: Tactical Volatility & Aggressive Vol strategies

Part 5: VB Threshold strategy

Part 6: Total Portfolio Solution & Leveraged Total Portfolio

When I launched VTS all the way back in January 2012, the Total Portfolio Solution was as follows:

50% Tactical Balanced strategy

30% Tactical Volatility strategy

20% VTS Iron Condors

I've always considered the Tactical Balanced strategy to be the "core" strategy in my portfolio and it remains so to this day. This strategy actually existed for me for several years before I launched it in 2012 as a solution to all the pitfalls of traditional buy and hold investing.

There are many variations of buy and hold portfolios out there and there's plenty of ways people can add different asset classes in different allocations to make them appear diversified and different, but you'd be surprised how similar most of them are from a correlation standpoint to a standard 50/30/20 stocks/bonds/gold portfolio. In a crisis, asset class correlations increase dramatically which means most investors are holding more or less the same garbage portfolio that will tank with the market and wipe out several years of progress.

So when I designed the Tactical Balanced strategy, it was to be direct competition to a buy & hold 50/30/20, but of course I would be tactically rotating through those positions and only holding what my volatility metrics deemed the highest probability of success at the time. While tactical strategies may not always outperform the market in really good times, there's no doubt in my mind that over longer periods when factoring in multiple economic cycles the outperformance will be as clear as day.

Why hold all 3 at once when we can just hold the best one?

- Stocks (MDY) for the most stable market periods

- Bonds (IEF) for the times when my signals are ambiguous

- Gold (GLD) for when the market is really melting down.

Since this article series is discussing how the strategies would have performed through the pandemic had we not moved to all cash and actually left the signals to trade, we're really focusing on those GLD Gold positions because that's what the strategy would have been in through March 2020.

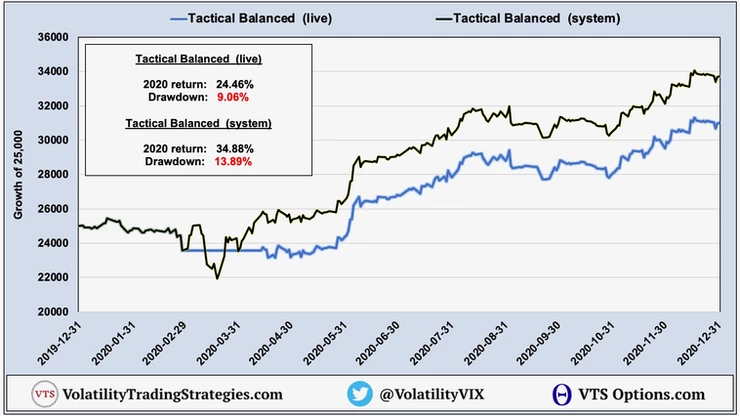

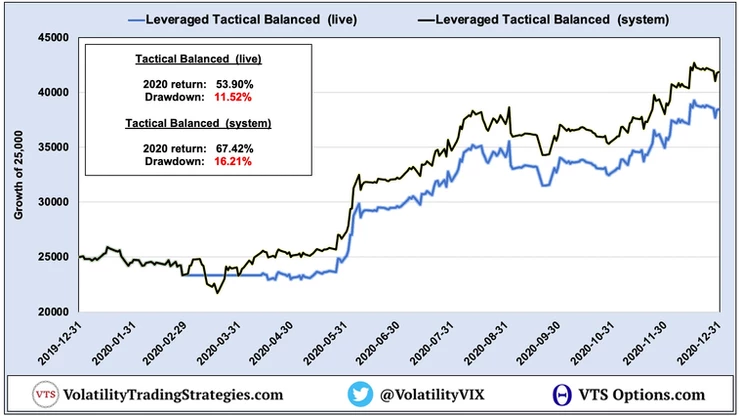

Overall in 2020 the Tactical Balanced and Leveraged Tactical Balanced performed very well returning 24.46% and 53.90% respectively. Given there was a 35% market crash that same year I'd say the strategy exceeded all expectations. In reality though, it may even have done a little better had we stayed the course through the pandemic.

Tactical Balanced strategy live vs following the signals in 2020:

One thing I mention a lot with respect to gold positions during a crisis, I actually expect 2 things out of them. First, on average in the long run through several market cycles, performance should be better than any other asset class aside from long volatility. Secondly though, we should expect the drawdowns to be larger as well because gold is a more volatile asset class in general.

We can see both of those would have played out in the above chart, with the systematic signals returning about 10% more on the year than our live trading did, but also adding 4% to the maximum drawdown.

Leveraged Tactical Balanced live vs following the signals in 2020:

It's the same story within the Leveraged Tactical Balanced as well with the systematic signals returning about 13% more on the year, but adding 5% to the maximum drawdown.

If you're getting value so far:

Subscribe to my YouTube channel

Gold performs well in a crisis, but don't ever over-allocate

While gold has historically been one of the best asset classes to hold during a market crash, there are good reasons to keep those allocations lower.

1) Through pretty much all market crashes, regardless of how well it performs on an absolute basis, we should expect the drawdowns to still be larger than cash. This is especially true in the early stages when it's not uncommon for investors to be panic selling without much thought as to what's going out the door. Sell everything, the world is ending feeling. Then with some time reality sets in, good decision making can return, and gold can start to gain a little more stability.

2) Performance does vary through different cycles. Sometimes it's exceptional and other times just adequate. I've done work to try to determine some variables that will give a higher probability of knowing how it will do in any given crisis, but gold is a tough asset class to figure out and it doesn't typically follow traditional patterns.

Given these and other reasons it's just best to have gold as part, but not all of a crisis plan. We'll want to spread out the risk and include cash and long volatility as well and that's why the Tactical Balanced strategy is the only one we have that will be holding gold in a crisis.

Take Control of your Financial Future!

Profitable strategies, professional risk management, and a fantastic community atmosphere of traders from around the world.